China’s mainland will hold 21% of the 200mm fab capacity share in 2022, according to SEMI’s 200mm Fab Outlook Report updated on April 11. Japan follows with 16% and the Taiwan region and Europe/Mideast at 15% each.

The Report shows that semiconductor manufacturers worldwide are on track to boost 200mm fab capacity by 1.2 million wafers, surging 21% to balance the supply and demand. From 2020 to 2024, the capacity is set to hit a record high of 6.9 million wafers per month.

Ajit Manocha, SEMI president, and CEO says “Wafer manufacturers will add 25 new 200mm lines over the five years to help meet the growing demand for applications such as 5G, automotive and Internet of Things devices that rely on analog, power management and display driver ICs, MOSFETs, microcontroller units and sensors.”

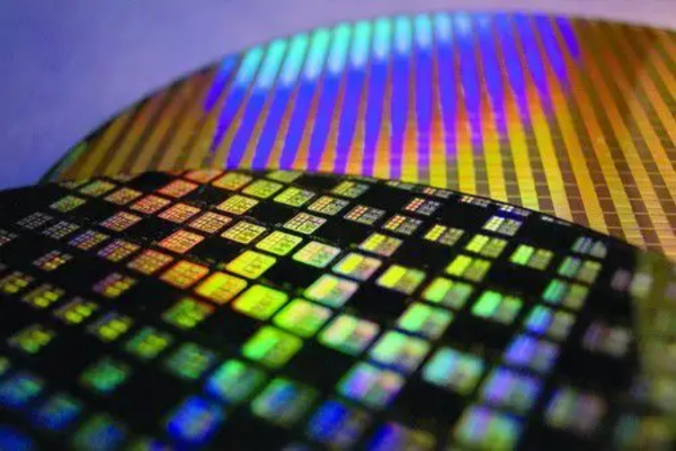

Source: SEMI

After climbing to $5.3 billion last year, 200mm fab equipment spending is projected to reach $4.9 billion in 2022 as 200mm fab utilization remains high and the global semiconductor industry works to overcome the chip shortage.

The Report also points out that the foundries will take up more than 50% of global fab capacity this year, followed by analog at 19% and discrete/power at 12%.

In 2023, the equipment spending is expected to remain above $3 billion, with the foundry sector accounting for 54%, followed by discrete/power at 20% and analog at 19%.

RELATED

-

China kicks off construction of world’s largest offshore PV power station

11-14 17:21 -

China's leading image sensor company Will Semiconductor issues GDR listing on the Swiss Stock Exchange

11-14 17:08 -

JW Insights: R&D expenses of 205 listed Chinese semiconductor companies total RMB52.6 billion ($7.22 billion) in the first three quarters of 2023

11-06 18:37

READ MOST

No Data Yet~