By Kate Yuan

China’s IC import has shown an 11.4% drop, nearly 24 billion pieces less in January-April over the same period last year, according to China’s General Administration of Customs (GACC). An article by JW Insights analyst Ai Meng looks into the different explanations for this phenomenon.

Some analysts say the import drop is caused by Chinese domestic OEMs reducing dependence on chip import from the U.S. and using more China-made substitutes including memory, MCU, RF chips, and analog ICs.

However, there could be other reasons for this phenomenon. Zhu Jing, deputy secretary-general of the Beijing Semiconductor Industry Association, said, “It is not very objective to jump to conclusions based just on the reduced number, considering the long IC industry chain and wide ranges of products.”

“It is still necessary to make comprehensive judgment combining import volume and products, domestic technology level and commercial situation,” Zhu added.

In addition, China’s chip import is rising in prices, but falling in quantity. The global chip shortage has pushed up the prices by 10%, reflecting another woe in China’s semiconductor industry.

According to the latest data from the National Bureau of Statistics, the China’s domestic IC output reduced by about 6 billion pieces in January-April compared with last year, far less than the 24 billion pieces import decrease.

Han Xiaomin, general manager of JW Insights’ consulting business, explained that “It is the top priority of domestic chip companies to secure production capacity in the past two years.”

“The slight decrease of import is largely caused by the Omicron pandemic lockdown in the Yangtze River Delta, the core chip production area, including production suspension and logistics interruptions,” he added.

Han Xiaomin pointed out that destocking by OEMs is another main reason for the import decline. With the chip shortages in the last couple of years, many OEMs stocked up IC inventory, pushing China’s IC import volume to a high level.

“On the other hand, the weak consumer market this year has forced domestic OEMs to lower their shipments. Order cut and destocking have directly led to the IC import drop,” Han explained.

Another senior industry insider linked the drop of China’s IC import to the U.S. ban of high-end chip sales to Chinese companies in HPC and autonomous driving.

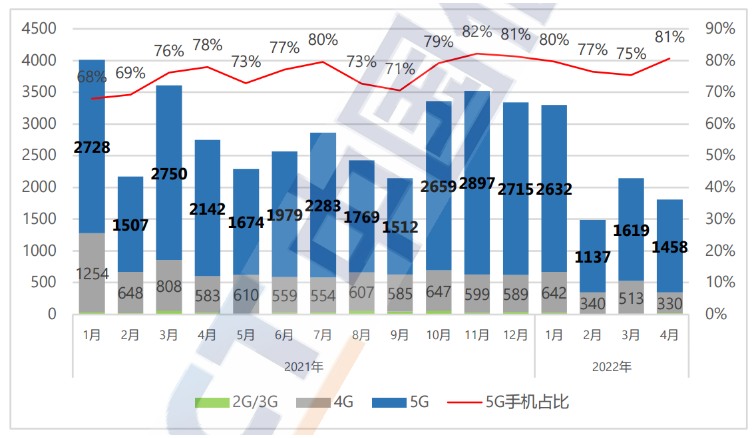

Approaching the mid-2022 now, China’s IC industry as well as the whole economy is experiencing more shocks. With weak demand for consumer electronics, the chip prices of memory, display panel driver and LED have fallen. However, the demands for industrial control, automotive electronics, and high-performance computing still remain strong. Structural chip shortage still exists. But their scale is much smaller when compared with consumer electronics including smartphones and PCs. This year's sluggish demand for consumer electronics will bring much worse effects.

Source: CAICT

“The global semiconductor industry went through a crazy growth from 2020 to 2021, driven by multiple factors such as Huawei’s hoarding of IC in the wake of the U.S. sanctions, the COVID-19 pandemic, and intensified anti-globalization,” Zhu said. The overstocked inventory could be much higher than the actual demand and may lead to a fiercer and ultra-long period of destocking in China, she predicted.

A crisis is looming. The scale of China’s investment in semiconductor is reduced with investors becoming more cautious; More startup companies are running into problems. These will lead to new changes in China’s semiconductor industry, Ai Meng’s article concluded.

RELATED

-

Local governments in China come up with policies to support AI development in 2023

11-17 19:12 -

NBS: China’s specialized equipment manufacturing industry for semiconductor devices sees 33.9% surge in value added in October

11-17 17:41 -

China's high-tech manufacturing loans see significant increase

11-14 17:08

READ MOST

No Data Yet~