By Li Panpan

Chinese battery manufacturers will start mass production of more semi-solid batteries in EVs this year after more technical tests and improvements. However, in the long term, semi-solid batteries won’t change the current battery supply system. Chinese battery giants like CATL are not betting big on them and still concentrate on solid-state battery innovation, JW Insights reported.

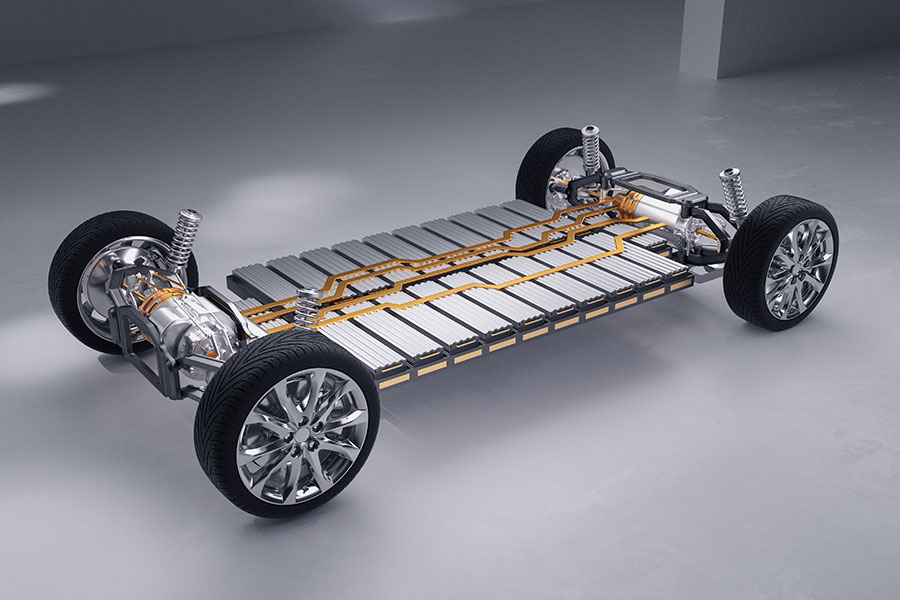

The current mainstream power battery choices are ternary lithium batteries and lithium iron phosphate batteries. However, neither of them can meet the needs for long battery life. Stacking batteries will increase the vehicle’s weight, which does not meet the needs of lightweight development. Therefore, the market needs a better power battery solution.

Semi-solid batteries have higher energy density with more safety and a wider temperature range. They could become one of the better options; many lithium battery companies and OEMs in China have selected them for related models.

Ganfeng Lithium (赣锋锂业), WeLion New Energy (卫蓝新能), CATL, Farasis Energy (孚能科技), Qingtao Energy (清陶能源), and other companies in China have undergone precipitation and vehicle verification in 2022. Some are expected to mass-produce semi-solid batteries in 2023.

In January 2022, the first batch of 50 Dongfeng E70s made their global debut with semi-solid batteries provided by Ganfeng Lithium. These cars were only in small-batch delivery for verification to offer operational data for mass production, said the JW Insights report.

On December 15, 2022, Voyah, a brand affiliated with Dongfeng Motor, officially released light-chasing sedans. Its 82kWh version is equipped with a semi-solid battery pack. The new cars will be delivered in the first half of this year. The car is also known as the world's first mass-produced semi-solid battery model.

The delivery of the NIO ET7 equipped with a 150KWh semi-solid battery has been delayed until the first half of 2023. The supplier is Welion New Energy, and Gotion Hi-Tech may also be one of the supporting manufacturers.

Other lithium battery suppliers are also accelerating the introduction of semi-solid batteries. CATL, which currently ranks first in the world in installed capacity of power batteries, plans to provide SERES 5’s 90kWh version with its semi-solid battery. It will feature a maximum cruising range (WLTP) of 530km, scheduled for delivery in March 2023.

Chinese and international OEMs like Changan, Hongqi, Toyota, Hyundai, Nissan, BMW, Volkswagen, and others have also increased the layout of solid-state battery production lines, said the JW Insights report.

However, although leading companies like BYD and CATL have plans for the semi-solid battery, CATL focuses more on its Kirin batteries with relatively low energy density and BYD on lithium iron phosphate blade battery solutions.

Analyst Chen Lei said, "The significant advantage of semi-solid batteries is to increase the energy density of current lithium batteries. But their cost is much higher than that of existing batteries.” So semi-solid batteries will not change the existing lithium battery supply system and are only applicable to some high-end models, said the JW Insights report.

What’s more, semi-solid battery products have no essential innovation compared with current batteries except for the electrolyte, and they have little effect on promoting solid-state batteries with higher energy density.

Ouyang Minggao, an academician of the Chinese Academy of Sciences, said China’s power battery innovation would gradually change from battery structure to materials. It is a more complicated and time-consuming process and a commanding height in global power battery innovation.

Therefore, CATL is not optimistic about the long-term development prospects of the semi-solid technology. It bets more on the structurally-innovated high-nickel solution.

BYD continues to increase the structural innovation of blade batteries and makes preparations for solid-state battery technology. Its number of solid-state battery patents reportedly ranks first in China.

There is data showing that solid-state batteries have more stable mechanical and chemical properties of the electrolyte with greatly improved static and cycle life. But the negative electrode materials and electrolytes of solid-state batteries are different from liquid lithium batteries. The supply chain needs to be reshaped, and the fast-charging efficiency must also be improved. To put it on the market, the cost must also be reduced. The process is “extremely arduous and long,” added Ouyang.

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26

READ MOST

No Data Yet~