By Li Panpan

(JW Insights) Mar 2 -- First-tier Chinese technology manufacturers and investors are setting sights on chassis by wire for new energy vehicles in the latest round of their investment to cash in on the fast-expanding EV market in China, said a recent JW Insights report by analyst Wang Liying.

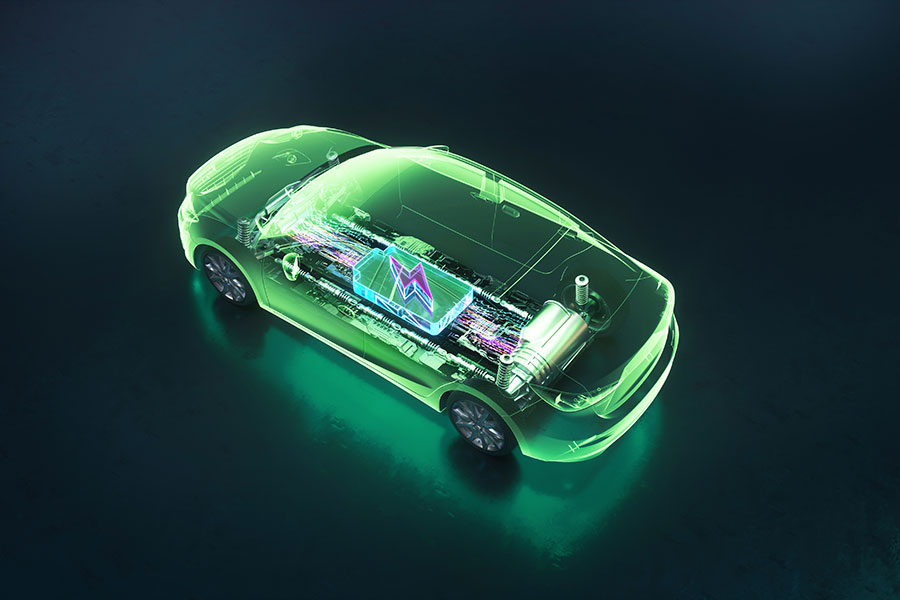

The automotive chassis by wire is mainly composed of steer by wire, brake by wire, gear shift by wire, throttle by wire, and suspension by wire (air suspension by wire, for example). It is the cornerstone of automatic driving that can realize the efficient and precise control of a car.

Judging from the current car-loading capacity, throttle by wire technology is relatively mature, with a penetration rate close to 100%; gear shift by wire technology is less complicated, with a relatively high penetration rate; brake by wire and suspension by wire technologies are relatively mature, with a low assembly rate; steer by wire technology is still under development with meager penetration rate.

Air suspension by wire can improve vehicle handling and comfort, reduce energy consumption and increase the cruising range. Chinese car brands like Nio, Li Auto, Xpeng, Dongfeng Motor, Geely, Hongqi, and SAIC Volkswagen have launched models with air suspension by wire or with that option.

With the mass production of L3-L4 autonomous driving vehicles, the necessity for chassis by wire has become increasingly prominent. It’s predicted that the penetration rate of brake by wire in China is expected to reach more than 30% in 2025, and the market size may reach RMB20 billion ($2.90 billion), with a compound annual growth rate (CAGR) of 43% from 2022 to 2025; The air suspension by wire market is expected to reach RMB33.1 billion ($4.80 billion) in 2025 with a CAGR of 69%.

International Tier 1 manufacturers like Bosch, Continental, ZF and Hitachi have been the dominant players in the global chassis by wire market for years.

Chinese chassis by wire companies are gradually rising, given enormous market potential brought by China's No.1 new energy vehicle position in production and sales volume.

In the field of brake-by-wire, the newly emerged Chinese leading makers are NASN Auto (拿森科技), Trinova Technology (英创汇智), Tongyu Automotive (同驭汽车), WBTL (伯特利), BYD, Leekr Technology (利氪科技), Exquisite Automotive (精工底盘), APG (亚太股份), and Trugo Technology (千顾科技).

In the field of air suspension by wire, there are Baolong Automotive (保隆科技), Zhongding Group (中鼎股份), Tuopu Group (拓普集团) to name the top ones.

Leading investment agencies have made their moves. NASN Auto completed its C-round financing of RMB500 million ($72.45 million) in December 2021, and Tongyu Automotive completed its A+ round of funding of nearly RMB200 million ($28.98 million).

Lately, startups like Global Technology (格陆博) and Jiyu Technology(济驭科技) received new financing.

Despite continuous investment and great market potential, Chinese chassis by wire companies still need to tackle many challenges.

The overall penetration rate of the chassis by wire is not high, especially the brake-by-wire with a higher technical threshold. Chinese players are basically in the development stage from 0 to 1.

What’s more, a broad set of industry benchmarks is needed. Different manufacturers and agencies have their own evaluation methods for chassis by wire products in various vehicle models with wasteful resources.

Chinese chassis by wire companies need to establish a technical moat to gain market recognition from vehicle manufacturers and cash in on the emerging blue ocean market of EVs in China.

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26

READ MOST

No Data Yet~