By Greg Gao

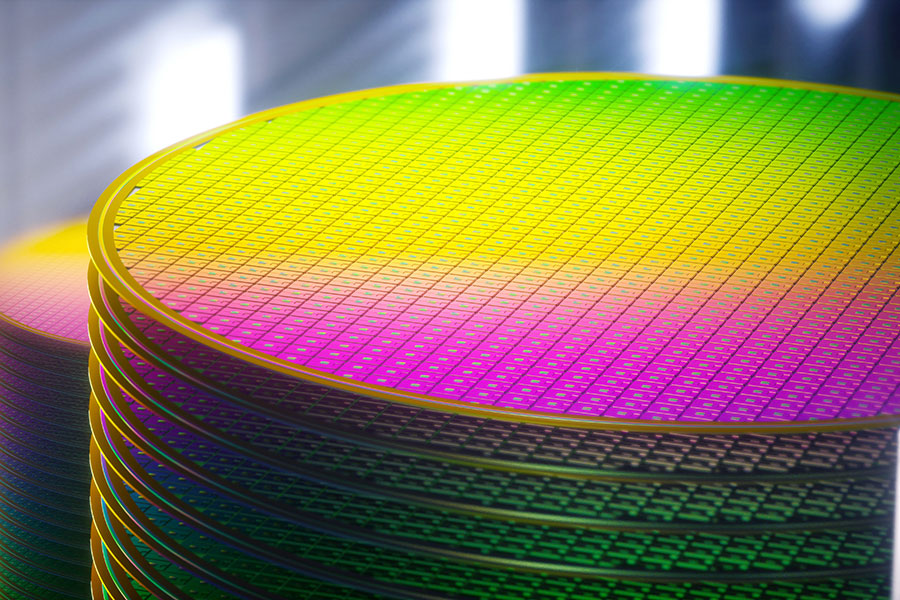

(JW Insights) Aug 8 -- China’s semiconductor players are stepping up efforts to make breakthroughs in critical areas such as equipment and materials and strive for self-sufficiency as Japan’s semiconductor equipment export control takes effect on July 23, industry experts pointed out recently.

The Japanese government introduced export control measures for semiconductor manufacturing equipment on May 23, including six categories and 23 types of equipment or items, such as lithography, etching, thermal processing, cleaning, and testing equipment. These measures took effect on July 23, primarily targeting high-end semiconductor manufacturing equipment.

“Given these export control measures, key upstream areas such as advanced processes below 14 nanometers in the semiconductor industry chain will be restricted. Additionally, the import procedures for certain equipment will become more complicated, leading to longer import processes and times. Companies need to be prepared for these challenges.” Xiao Xu, an industry expert, stated in an interview with China’s news outlet Securities Daily.

Japan’s control measures cover manufacturing equipment related to extreme ultraviolet (EUV) technology and etching equipment for stacking storage components.

“This means that Chinese semiconductor companies will face restrictions on importing products related to high-end advanced processes such as 14, 7, and 3 nm and below. The scope of control has expanded, primarily involving key areas such as lithography machines and advanced optical materials. This will restrict China’s research and development of cutting-edge chips in fields such as AI, new energy, smart cars, and high-end smartphones, thereby affecting the iterative development of strategic industries.” Chen Jia, a researcher at the International Monetary Institute of the Renmin University of China, told Securities Daily.

Hong Yong, an expert from a think tank in China, pointed out, “As Japan has implemented an export license system, Chinese companies need to obtain separate licenses approved by the Japanese Minister of Economy, Trade, and Industry for the import of restricted products. This will increase the procedural and time costs of imports, potentially disrupting the supply chain or causing delays, impacting the global semiconductor supply chain simultaneously.”

“When critical equipment is blocked, enterprises will face rising production costs and even supply chain interruptions. Domestic industry chain players also need to seek alternative supply chains or strengthen independent research and development capabilities, as well as enhance cooperation with other companies to jointly promote the development and improvement of the semiconductor industry in China.” Hong Yong added.

China is one of the major export destinations for Japanese semiconductor equipment, accounting for nearly 40%. Therefore, Japanese electronics companies are highly reliant on China’s semiconductor supply chain. With the implementation of export restrictions, the operations of over a dozen Japanese companies, such as Tokyo Electron, Nikon, and Sony, could be affected.

Currently, numerous Chinese IC companies have made breakthroughs in key areas. Loongson Technology has launched the fully independent LoongArch instruction set architecture, achieving a historic breakthrough in chip industry security and control. Huawei’s integrated circuit design arm HiSilicon boasts world-class ARM chip design capabilities that challenge Qualcomm. Micro-fabrication equipment company AMEC’s etching process is world-leading, dominating the industry chain. SMIC has achieved mass production at the 14 nm process chips, with a yield rate reaching a world-leading level. Unisoc and China’s leading OSAT company JCET Group have launched independently developed 5G RF chips.

Although there is still significant room for improvement in China’s semiconductor industry, such as EDA design tools, EUV lithography machines, and a relatively high dependence on core materials from overseas, China’s semiconductor players have begun to free themselves from complete dependence in areas of chip fabrication and design. Further breakthroughs are needed in critical areas such as semiconductor equipment and materials, the Chinese experts, said the Securities Daily report.

RELATED

-

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Local governments in China come up with policies to support AI development in 2023

11-17 19:12