(JW Insights) Oct 12 -- Chinese battery companies critical to electric vehicles are pursuing deals with U.S. free-trade partners South Korea and Morocco, seeking to tap growing demand in America and bypass rules aimed at shutting them out of the market, reported the Wall Street Journal on October 12.

Chinese businesses that supply raw materials to make EV batteries have announced at least nine joint ventures and investments worth more than $4.5 billion in South Korea this year, according to a Wall Street Journal review of stock exchange filings.

At least four Chinese firms said they plan to build plants in Morocco producing battery-related products. Morocco sits on over 70% of the world's known phosphate reserve, a raw material key to EV batteries.

By working out of the two countries, the Chinese suppliers hope to supply car and battery makers eligible for incentives doled out by the $430 billion Inflation Reduction Act, which rewards businesses that source materials domestically or from free-trade partners.

Analysts say Chinese suppliers hope such joint ventures will allow customers to continue sourcing from them and still access incentives, which offsets more than one-tenth the cost of an average EV, reported the Wall Street Journal .

An executive at Shenzhen, China-based GEM said its partnership with a South Korean firm would help the raw material refiner meet IRA conditions and help the firm tap demand for EVs globally.

South Korea EV suppliers benefit from partnering with Chinese firms to access key materials and expertise in processing, industry experts say.

Analysts say one wild card is that U.S. authorities haven't defined what constitutes a "foreign entity of concern" in the IRA. The U.S. hasn't defined what level of Chinese involvement and at what stage of the supply chain is acceptable for auto and battery producers to qualify for tax credits, they say.

This uncertainty means there is a risk that such joint ventures could ultimately be barred from receiving incentives, said Chris Berry, founder of energy metals consulting firm House Mountain Partners. "How involved China can be with different parts of the supply chain is an open question," Berry said.

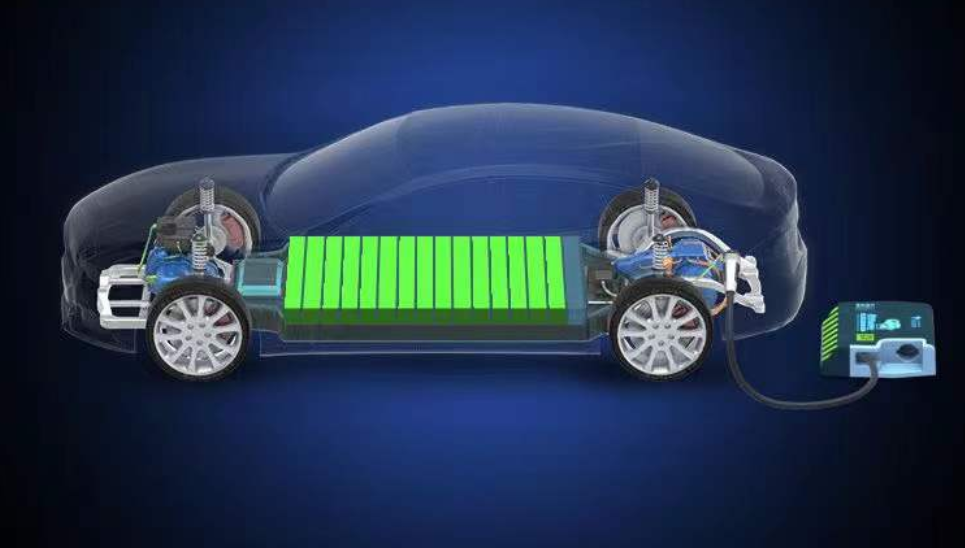

Chinese companies are the world's biggest producers of the four key components needed in EV battery production—cathodes, anodes, electrolytes and separators, according to industry analyst SNE Research.

The country has a chokehold over much of the capacity needed to refine metals such as lithium, cobalt and manganese to make them suitable for battery production, said Lukasz Bednarski, a research analyst at S&P Global.

As a result, it is difficult for the U.S. and Europe to build an independent EV battery supply chain without China's help, at least in the near term, Bednarski added, according to the Wall Street Journal report.

(Li PP)

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59

READ MOST

No Data Yet~