By Gabby Chen

(JW Insights) May 29 -- The semiconductor material silicon carbide (SiC) is experiencing a significant surge as manufacturers worldwide actively expand their operations in this sector, according to a recent JW Insights report.

SiC power devices, known for their superior performance and efficiency, are expected to capture around 30% of the overall power device market in the near future. Market research firm Yole predicts the SiC industry, including substrates, modules, and devices, will exceed $6 billion by 2027.

Among the emerging trends, the IDM (integrated device manufacturer) model has become a crucial strategy for industry development, enabling collaboration between design and manufacturing, accelerating product development cycles and fostering technological advantages.

STMicroelectronics (ST), a multinational electronics and semiconductors manufacturer, has achieved remarkable success in the SiC market, with shipments of automotive-grade SiC devices surpassing 100 million units since commencing mass production.

In 2022, SiC production capacity climbed by over 2.5 times compared to 2020, thanks to ST's steadfast vertical integration strategy. They are targeting an internal supply of over 40% SiC substrates by 2024.

Cao Zhiping, president of ST China, emphasizes the importance of full control over the manufacturing chain for SiC, including substrates, wafer manufacturing, testing, and customized power modules.

ST's acquisition of Norstel AB, a substrate and epitaxy manufacturer, has allowed the company to enter the uppermost segment of the SiC supply chain and establish a complete manufacturing chain.

Cao highlights that integrating substrates into the manufacturing chain enables cost control, higher production yield, and enhanced flexibility in meeting market demand.

Other leading SiC manufacturers are also strengthening their capabilities through strategic acquisitions. For instance,the American semiconductor supplier ON Semi acquired substrate manufacturer GT Advanced Technologies, while Rohm Semiconductor, a Japanese electronic parts manufacturer, secured its position in the SiC market by acquiring SiCrystal, a SiC substrate supplier.

Zhu Hangou, a senior analyst at JW Insights, emphasized that the IDM model provides stable product quality, supply capacity, and safeguards critical manufacturing processes that directly influence product performance.

In the transition to the IDM model, strong SiC substrate manufacturing capabilities play a vital role in cost and product quality. Data reveals that SiC substrates contribute to 46% of the average cost of SiC devices.

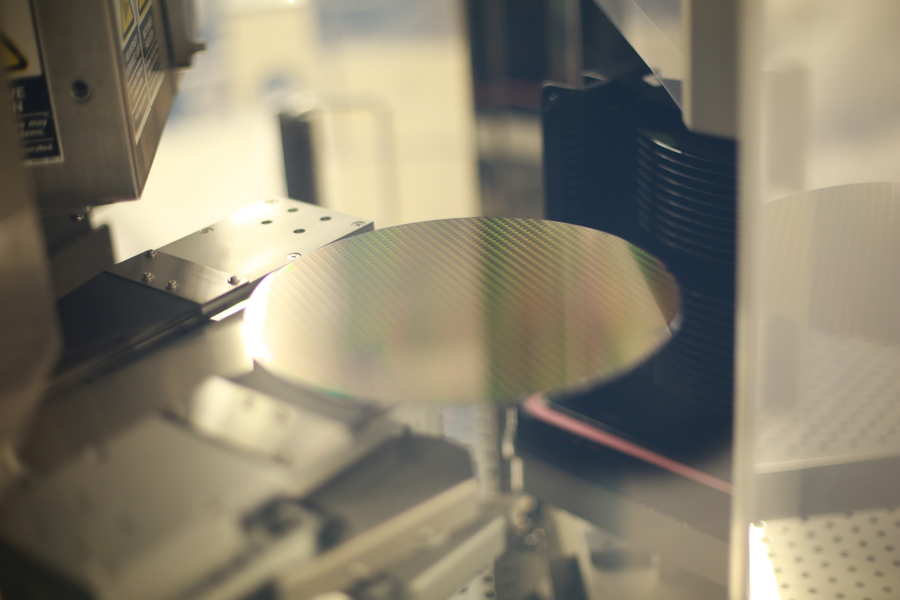

To meet the demand for larger sizes in high-power applications, the industry is actively pursuing the adoption of 8-inch SiC substrates. This transition is not only driven by market requirements but also serves as a strategic approach to lower the cost of SiC power devices.

In September 2022, US wide-bandgap semiconductors supplier Wolfspeed announced a $1.3 billion investment to build the world's largest SiC substrate plant in North Carolina. The facility will specialize in producing 8-inch SiC substrates to meet the increasing demand for SiC-based applications.

Currently, Wolfspeed holds the exclusive position as the sole global producer of 8-inch SiC wafers, a status expected to continue for the next two to three years until other companies expand their production capacities.

ST is also undergoing an 8-inch upgrade, while its Norstel AB plant has successfully launched the first batch of in-house 8-inch prototype wafers.

Additionally, Rohm and German chip giant Infineon plan to commence the mass production of 8-inch SiC wafers around 2023.

Poshun Chiu, a senior analyst at Yole Intelligence, stated, "The establishment of 8-inch wafer fabs and the expansion of material capacity demonstrate the ambitious goals for the coming decade, with large-sized substrates serving as a strategic resource for next-generation device manufacturing," said the JW Insights report.

RELATED

-

Chinese top-tier chipmaker HuaHong Semiconductor's net profit plummets 86 percent in the third quarter

11-17 19:11 -

Chinese MEMS provider Fatri UTC will set up its sensor chip production plant in Shanghai

11-16 18:30 -

China's packaging and testing services provider Forehope Electronic will build a new plant with RMB2.157 billion investment

11-15 17:17

READ MOST

No Data Yet~