Editing by Kate Yuan

JW Insights released in mid-May the 1st part of a white paper on talents in China's IC industry. It showed the shortage of IC professionals was about 200,000 in 2020, while the country's IC development momentum is at an all-time high amid a geopolitical rivalry between China and U.S.

The number of IC job positions was estimated at 720,000 last year, leaving a 200,000 gap. The demands for top-level managerial and inter-disciplinary and innovative-minded engineers are particularly high, said the report by JW Insights, China’s leading information and consulting service provider focused on the semiconductor and ICT industries.

The JW Insights While Paper on IC Talents in China results from half-year joint research with major recruitment and job market research firms Taihe Consulting, 51job, and Hibo Group. It looks into the subject from the total employment, educational background, job functions, salaries, and policies. It has three parts: the 1st part on the status quo and prospect of China IC industry talents. The final part will be released at JW Insights annual summit on June 25-26 in Xiamen, Fujian Province, southeastern China.

The 2019-2020 version of the JW Insights White Paper on the same subject estimated that the demands for IC talents would reach 744,500 in 2022, based on the industry development trend and corresponding per capita output value. The estimated breakdown by sector is 270,400 in design, 264,300 in manufacturing, and 209,8000 in packaging and testing.

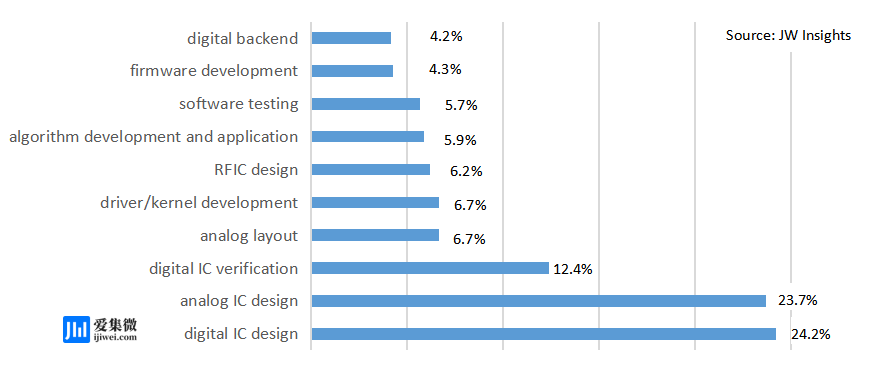

The white paper also gives the breakdown of the top 10 job types. Those related to IC design, including analog and digital design, accounted for 48% of the total demand.

According to the report, in 2020, China’s IC industry experienced a higher and unhealthy employee turnover rate than other industries. It was attributed to three major factors: salaries, personal choices, and development opportunities, accounting for 69.9%, 56.6%, and 37.3%, respectively.

After the COVID-19 pandemic broke out in the early stage, some companies cut salaries; when the pandemic was under control in the country, many companies went back to normal and competed to recruit more people, said the report.

Quickened development brought fierce competition in the industry, causing higher work intensity and many positions requiring night shifts. As a result, some people changed their jobs for family or health considerations.

Despite the higher employee turnover rate, recruiting remains strong. The listed IC and semiconductor companies reported an 11.2% increase in recruitments.

Surprisingly, the high turnover rate was not caused by more active job seekers. Compared with 2019, the number of job vacancies and applications decreased in the first quarter of 2020, the worst pandemic period in the country. In the 2nd quarter of 2020, the usual time for more job change, the number of applications increased slightly. In the second half of the year, there were still fewer job applicants, despite recovered business and more job openings.

The situation is leading to a bigger talent shortage in the IC job market. More companies turned to headhunters and internal referrals.

The IC industry positions in China had a reputation as being more stressful with low income. Things are changing now, notably with salary increases.

According to Taihe Consulting, the salary of China's IC industry increased by 8.0% in 2020, and the growth rate will reach 9.0% in 2021.

Both the industry and various government departments are taking more action to tackle this shortage of IC professionals, such as offering more attractive bonuses and housing allowances.

Local universities are encouraged to work with companies and research institutes to train more IC graduates in various ways.

RELATED

No Data Yet~

READ MOST

No Data Yet~