Edited by Li Panpan

Chinese companies are making breakthroughs in the 5G radio frequency chip filters to join the supplier list along with international giants.

Chinese listed analog chip companies Fuman Microelectronics(富满微) and Vanchip Tech(唯捷创芯)said their 5G RF chips have started supplies to Chinese mainstream mobile phone and ODM manufacturers. Industry observers call it a major indicator of technological progress by Chinese semiconductor companies.

According to statistics, the market value of the current global RF device market is about $15 billion; filters account for $8.1 billion. China used to depend heavily on imports for such products.

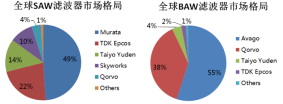

Mid-to-high-end filters can be mainly divided into surface acoustic waves (SAW) and bulk acoustic waves (BAW). Japan’s Murata mainly dominates the SAW filter market, and the BAW filter market is dominated by Broadcom, Skyworks, Qorvo, and Qualcomm, with extensive patents. Compared to them, the global market share of Chinese companies is tiny.

BAW filters have the advantages of high frequency and large bandwidth, slight insertion loss, large out-of-band attenuation, and are not sensitive to temperature changes, therefore being widely used.

MEMS company MEMSonics(武汉敏声) led BAW development in China. Last August, it started to build an 8-inch RF filter production line with Sai Microelectronics(赛微电子), the parent company of Silex, the world’s largest MEMS foundry and it is expected to be put into production by the end of 2022, with a production capacity of about 2,000 pieces per month.

With more than 100 technical patents, MEMSonics said that it can bypass AVAGO’s patent barriers with similar technology. It mastered the whole process of the high Scandium-doped Aluminum Nitride, the most challenging part of developing BAW filters.

Other Chinese companies have also made breakthroughs in the aluminum nitride material system.

Earlier in 2021, startup Ultratrend Technologies (奥趋光电) launched a self-developed sapphire-based aluminum-scandium-nitrogen thin-film template product. Its founder, Wu Liang, said it cooperates with leading downstream enterprises in China to manufacture a high-performance 5G FBAR/BAW/SAW filter.

Wu Liang added China’s overall industry ecosystem is still weak, and Chinese companies still depend to a considerable extent on overseas suppliers in simulation and design tools and production equipment. ”

As for the SAW filters, most Chinese companies’ products are with lower frequencies, for it is not as technically challenging as BAW.

However, the price war makes it difficult for them to increase gross profit and lengthens the payback period of early investment. With the upstream core materials controlled by Japanese companies such as Sumitomo Chemical and Shin-Etsu Chemical, the profits made by Chinese filter manufacturers reflow to Japanese companies through high-priced substrates.

Industry leader Murata leads in high-end SAW filter technology. Its IHP-SAW technology can achieve 2.5-3GHz and even higher frequency performance, way better than the traditional SAW filters with less than 1.8GHz.

Chinese companies are also working on high-end technology in SAW. Gao Yang’s team from Southwest University of Science and Technology and Ou Xin’s team from Shanghai Institute of Microsystems and the Chinese Academy of Sciences have made significant progress. And Gao Yang’s team established a joint laboratory of intelligent microsystems with OnMicro(昂瑞微), an active player in the Chinese 5G RF chip field.