Editing by Kate Yuan

Chinese mainland's share of the pure-play foundry market increased by 0.9 percentage points to 8.5% in 2021 thanks to the excellent performance of Chinese foundries, according to IC Insights.

In 2021, SMIC's sales jumped by 39% compared to the 26% increase in the global foundry market. Huahong Group's sales growth rate last year doubled the total foundry market, reaching 52%.

IC Insights believes that the Chinese mainland’s total share of the pure-play foundry market will remain relatively flat through 2026. Although mainland Chinese foundries plan to use the public and private capital investment to increase semiconductor market infrastructure in the next five years, they still lack competitiveness in the high-end foundry field.

It is expected that by 2026, the Chinese mainland’s foundries will take up 8.8% of the pure-play foundry market, which is 2.6 percentage points lower than the peak share of 11.4% in 2006.

Nine of the top 12 foundries in 2021 were located in the Asia-Pacific region. Europe-based specialty foundry X-Fab, Israel- headquartered Tower (now expected to be acquired by Intel) and US-based GlobalFoundries were the only non-Asia-Pacific companies to make the top 12 last year.

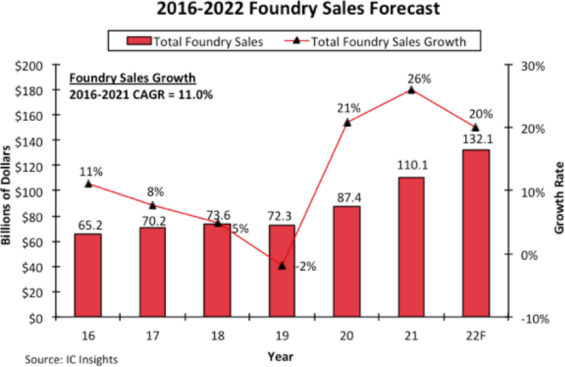

After the 2% fall in 2019, the global foundry market saw a strong rebound of 21% in 2020, driven by application processors and other telecom device sales into 5G smartphones. The market continued to grow in 2021, jumping by 26%.

If IC Insights' forecast 20% growth in the global foundry market can be achieved this year, the 2020-2022 period will be the strongest three-year growth span for the entire foundry market since 2002-2004, commented a Chinese semiconductor observer.