By Miranda Li

The boom in China’s semiconductor testing industry has triggered solid demands for more equipment and components, especially probe cards for testing equipment. In 2021, China’s domestic probe card market rose to RMB3 billion ($470.7 million). With their strength in short-time delivery, good service, and lower price, the Chinese domestic probe card manufacturers have started to gain market share, now on the threshold of 2%, according to a JW Insights analyst’s article.

Under Moore’s law, as technologies progressed, the line width of advanced semiconductor processes is reduced to 10 nm, 7 nm, and even 5 nm. The manufacturing cost of chips, whether in the wafer manufacturing or the later packaging, increases day by day. Therefore, as a vital process for verifying and inspecting IC products, testing becomes more critical.

Currently, most Chinese factories rely on imports to meet probe card needs. The geopolitical changes are changing the mindsets of Chinese companies. More are developing homemade probe cards.

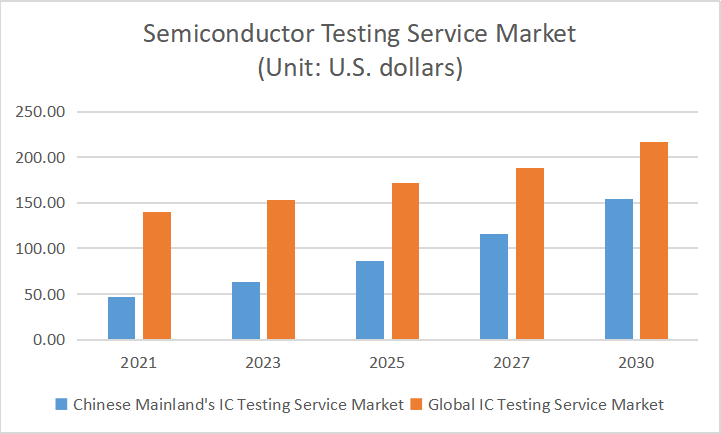

Source: Gartner and French CLSA Asia-Pacific Markets

According to Gartner and French CLSA Asia-Pacific Markets, the Chinese mainland’s testing service market in 2021 was RMB30 billion ($47.07 billion), while the global market was RMB89.2 billion ($14 billion). By 2025, China’s testing service market is estimated to reach RMB55 billion ($8.63 billion), accounting for 50.3%, as the global share is to get about RMB109.4 billion ($17.16 billion). There is a vast growth potential of more than RMB25 billion ($3.92 billion) in domestic markets in five years.

According to JW Insights, about 70% of the market share is with the top five probe card manufacturers in the world, especially the top three - the U.S-based FormFactor, Italy-based Technoprobe, and Japan-based IMJC. They hold 56% market share, more than half of the global market. Tens of the other manufacturers are left with the remaining 30% market share.

Japanese company MJC and two Chinese Taiwanese companies CHPT (Chunghwa Precision Test Tech.) and MPI corporation have set up their factories on China’s mainland.

There also emerged a group of domestic probe card manufacturers. Represented by MaxOne Semiconductor(强一半导体) and Shanghai Zenfocus Semiconductor Technology(泽丰半导体), these up-rising Chinese probe card manufacturers compete to provide comprehensive solutions for the semiconductor testing market not only in China but also worldwide with their faster delivery, better service, and lower prices.

It is anticipated that the rapid growth of domestic test probe card enterprises will gradually narrow the gap with their international competitors. Dependence on imports will be progressively reduced, the JW Insights article points out.

RELATED

-

JW Insights: China's packaging and testing industry has not bottomed out yet in Q2, faced with weaker market demands

07-28 17:01 -

JW Insights: Packaging and testing, instead of wafer fabrication capacity, is the new blockade behind China’s automotive-grade MCU supply chain constraints

08-22 17:28 -

China’s leading IC testing company Leadyo completes world’s first 3nm chip test

07-13 15:50

READ MOST

No Data Yet~