By JW Insights

Business transformation is a pivotal challenge decision makers face in terms of future strategy. On this topic, we share with you several key considerations from the evaluation of how a long-established memory card OEM transformed into the automotive electronics market. We also hope that this sharing will serve as an opportunity for those who are interested or already in the field of automotive electronics to review and understand what resources are needed and how to prepare for the field of automotive electronics.

This article will first focus on the market to see what is required to enter the automotive electronics industry and how to screen and eliminate uncompetitive products, as well as the thresholds to be expected when transitioning from general consumer electronics into the automotive electronics market.

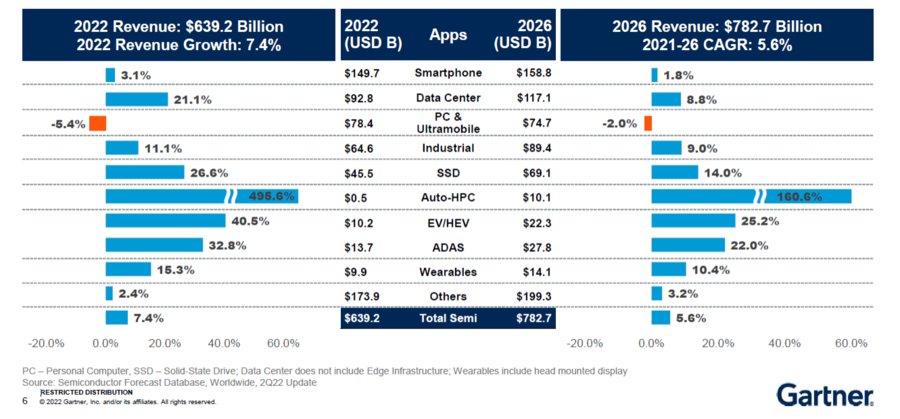

Figure1:Auto Shows Strong Growth

(Source: Gartner, SEMICON TAIWAN, Sep, 2022)

Gartner's analysis presented at Semicon Taiwan in September this year revealed several pointers, as indicated in the nodes in Figure 1, such as: until 2026, we can see that the smartphone is growing slightly, but the PC is in decline. SSDs have also seen some growth, while in the three sectors of automotive electronics, the growth trajectory is very significant, about 10x higher than before.

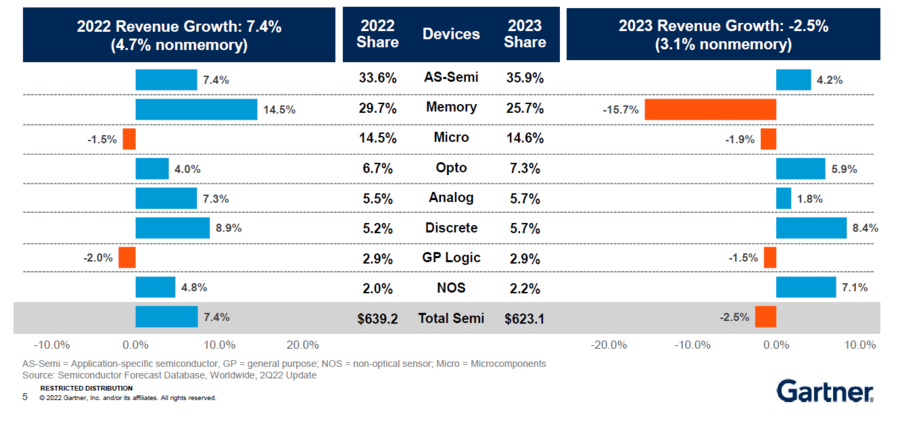

Figure2:Memory Market Weakens in 2023

(Source: Gartner, SEMICON TAIWAN, Sep, 2022)

In Figure 1, which shows the key developments in the years until 2026, according to Gartner's analysis (Figure 2), it can be seen that the memory industry is expected to decline by almost 16% next year. This is also one of the catalysts driving the senior management of the companies I mentored in their efforts to transition their business, as well as to assess the threshold in preparation and the cost required to enter automotive electronics industry.

The Difference Between Automotive Electronics and Consumer Electronics

Generally speaking, there is a dizzying array of regulations when it comes to automotive electronics; so how does one come to grips with the maze of standards and regulations? To this end, since we are already in the game, or even those who are about to enter the game, we need to familiarize ourselves with these regulations to evaluate the resources and costs required.

The following are examples of essential regulations to grasp:

* ISO/ IATF * AEC-Q001Guidelines for Part Average Test * AEC-Q002Guidelines for Statistical Yield Analysis * AEC-Q003Guidelines for Characterizing Electrical Performance of IC * AEC-Q100Stress Qualification for IC * AEC-CDCCertificate of Design, Construction and Qualification * AEC-QDPQualification Test Plan * PPAPProduct Part Approval Process * FMEAFailure Mode and Effect Analysis * VDA 6.3, Continental, Bosch, Renesas,….etc.

Basic requirements of the quality system, ISO and IATF is the first thing we need to understand. Furthermore, we need to familiarize ourselves with AEC Q001, Q002, Q003 and most importantly the Q100. Quality tools such as PPAP and FMPA that we are already familiar with in the consumer electronics industry.

In terms of end customers, we focus mainly on customers in Europe and Japan. Especially in Europe, because of their industry automotive industry. Therefore, the automotive electronics industry is traditionally dominated by European and Japanese manufacturers. For example: VDA 6.3, Continental, Bosch, Renesas (a major Japanese automotive electronics manufacturer) and other majors.

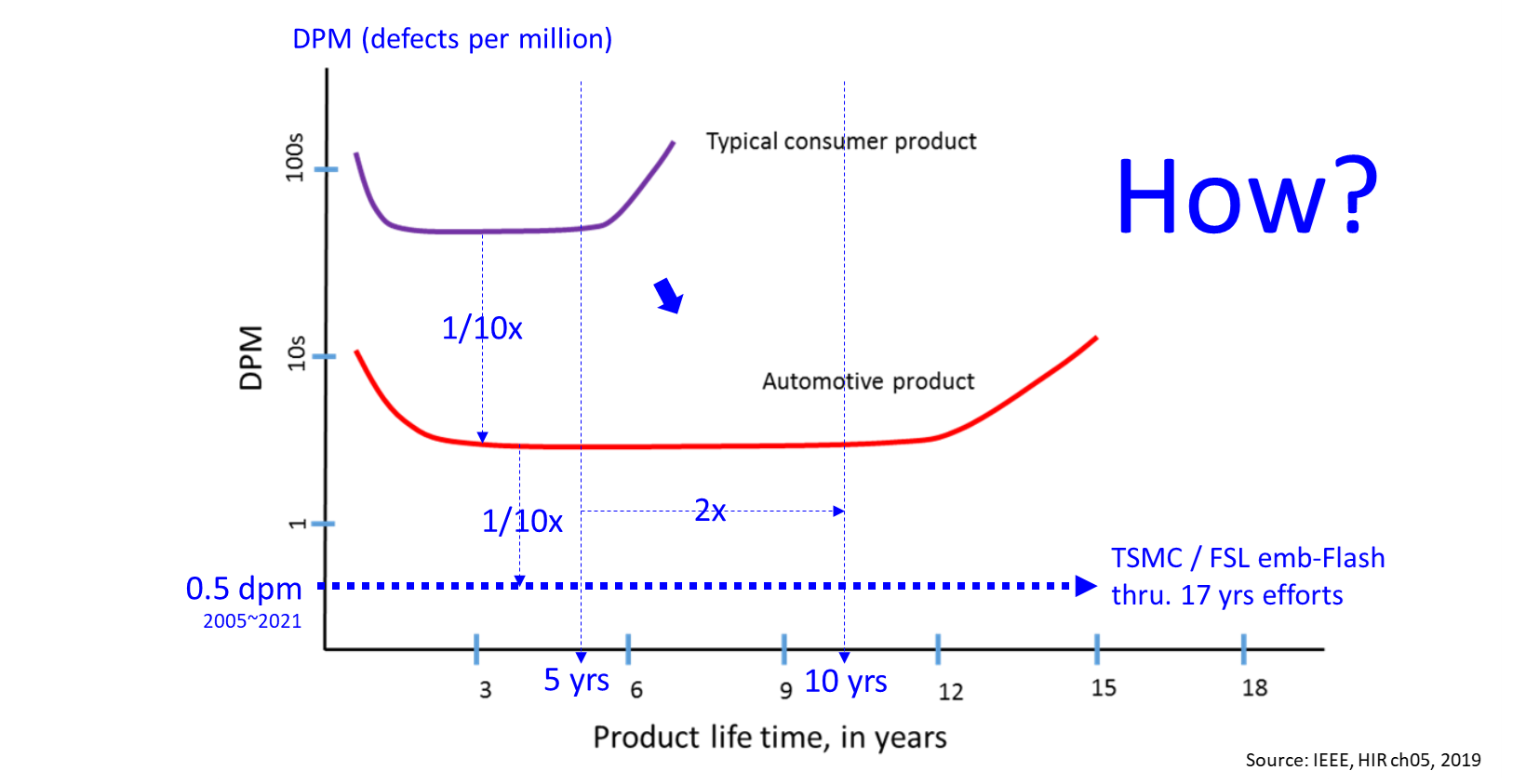

Figure3:Different Quality Requirements

(source:IEEE, HIR ch05, 2019)

In my answer to the impression of quality differences, this can be analyzed from the IEEE data (Figure 3), where the vertical axis Defects Per Million (DPM) refer to the failure rate and the horizontal axis is the service lifespan. The purple line represents consumer electronic products, where the failure rate is expected to increase significantly to a complete failure after about five years of service life. The initial failure rate of automotive electronics is very low, only about one-tenth of consumer electronics and the useful lifespan of automotive electronics is relatively long, almost all can last more than 10 years, which has become the most basic requirement of automotive electronics.

Last year 2021, there was a news article that TSMC collaborated with Freescale for developing automotive embedded flash from 2005 to last year (2021). After 17 years of concerted efforts, the failure rate was reduced to 0.5 DPM, which when compared with general automotive electronics, sees another tenth in reduction the failure rates.

However, how can the basic failure rate be one-tenth and the service life be increased by more than two times?

"HOW?" is the most determining factor for those of us who are already in the field of automotive electronics or who are ready to enter the market.

Standards and Regulations for Automotive Electronics

Product

* Reliability(0~5ppm) e.g.: Figure 3 red line * Text Methodology: How to achieve 0~5ppm * Part Average Test (PAT) * Special Bin Control (SBC) * Special Bin Limit (SBL) * Below Minimum Yield (BMY) * Extended Operating Temperature * Product Qual Requirement

Operation

* Operations * Tighten Process Control / Inspection / Scrap Limit * Process Change Control * Audit, PPAP, FMEA * Cpk ≧ 1.67 * Capacity (upside / pull-in to prevent line down) * Record Retention (15 years)

Supporting

* Business Process Infrastructure * Liability (Legal and Financial)

After condensing the many specifications into the above points, first of all, on the product side, the first thing to understand is how the Reliability value 0~5 dpm (Figure 3 red line) could be achieved. We need to fully understand the "Text Methodology" and be familiar with application tools such as: PAT, SBC, SBL and BMY. Secondly, since cars sometimes run in extremely high temperatures or extreme cold, such as the arctic regions, the conditions required will be different, so it is important to know what the operating temperature of the product is. Then, from the operating temperature of the product, we can extend to the items that should be done in product quality and the corresponding conditions.

In terms of operations, what are the key controls in the manufacturing process? For example: In process control, the inspection procedures/steps for automotive electronics will be more than those for consumer electronics, and the degree of scrapping is relatively higher. How do we implement Change Control for automotive electronics? The PPAP and FMEA audits for automotive electronics are also important. Furthermore, the key point is that the Cpk of the process is clearly defined in the specification to be greater than 1.67. Also, many of you might be aware that the life cycle of automotive electronics is long and the gross profit is high. Therefore, when executing these special controls, it is also important to consider how to make records and backup data. Since cars have been used for about 5 to 10 years or more, it is important that we keep a backup of the data for more than 15 years when we need to conduct a review or inquiry. Lastly, since the aftereffects of automotive electronics are relatively large, if our electronic components are used in braking ABS, or if there are safety concerns, the chances of liability claims or recalls will be very high. Therefore, it is particularly important for logistics and supporting functions to provide holistic support from the basic process, financial integrity to related laws and regulations.

Extended Operating Temperature

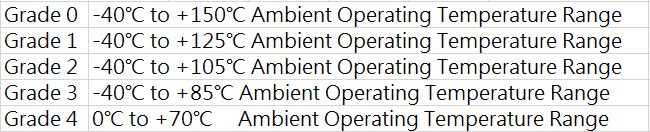

Table1:Automotive Industry Standards / Specs (AEC-Q100)

Section 1.3.2, Definition of Part Operating Temperature Grade

From the product side, the first step is to decide what grade the operating temperature of the product is. The general operating temperature of consumer electronics is about Grade 4, while for automotive electronics, it ranges from Grade 4 to Grade 0. Because cars may be operated in the high latitude cold regions or in the hot temperatures of Africa, the base threshold is generally Grade 3.

There are different quality and product requirements for the different grades. In the field of automotive electronics, the smaller the grade, the higher the required quality.

Survival of the Fittest

How do we ensure "survival of the fittest" to achieve the performance of TSMC and Freescale embedded-flash? We need to conduct a screening approach, such as: Be familiar with the principles and applications of Part Average Test (PAT), Special Bin Control (SBC), Special Bin Limit (SBL), and Below Minimum Yield (BMY).

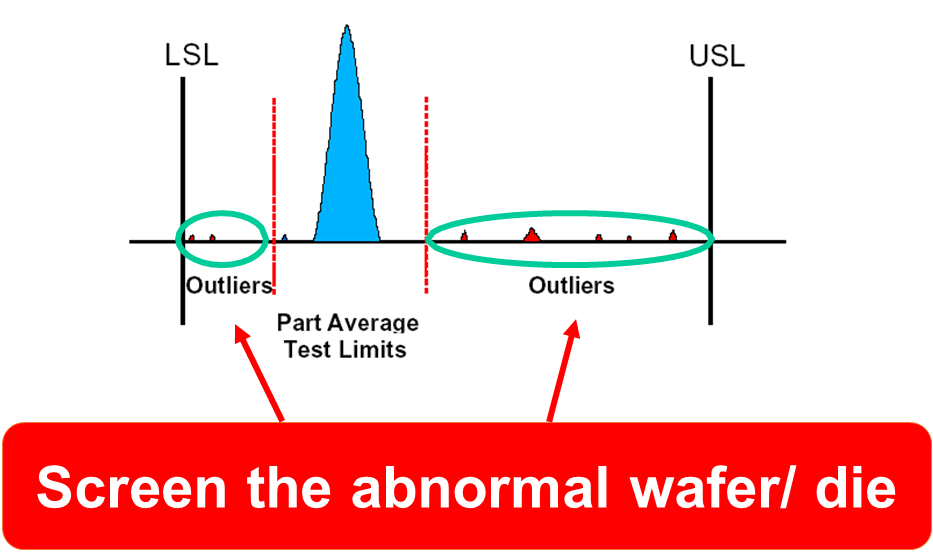

Figure4:Part Average Test (PAT)

Set test limits according to statistical data, instead of using spec with guard-band.

Take PAT as an example; in Figure 4, the vertical axis is the quantity and the horizontal axis is the engineering value. The blue area shows the normal distribution where most of the values fall. While there are also red outliers (abnormalities).

In "survival of the fittest," the "fittest" is the value in the blue range, and the remaining red outliers are eliminated.

Basically, the so-called "survival of the fittest," is to leave these major values and eliminate the outliers. Such is the concept and approach.

Next, we will explain the necessary conditions for this approach:

1. In addition to the specifications, LSL & USL,

2. We also need to have some statistical methods and concepts to remove the outliers.

3. We need to have a statistical system that can respond to this promptly and remove this weak part in a timely manner.

Gap Analysis

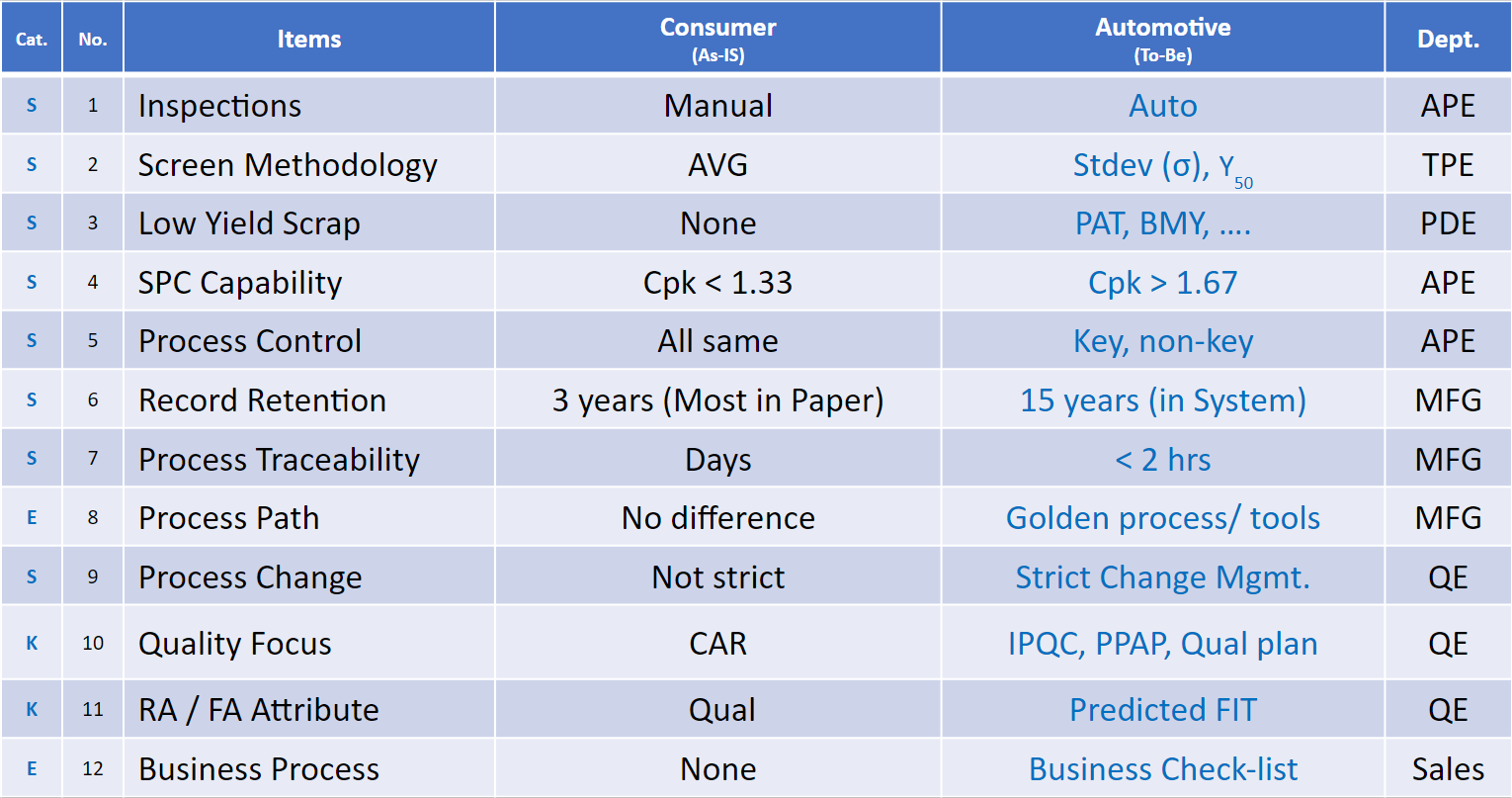

Table2:Gap Analysis

Table 2 compares the items we need to complete to transition from consumer electronics to automotive electronics. The categories of S, E and K represent the different categories of System requirements, Execution and Knowledge. The responsible departments corresponding to each item are also listed in the last column of Dept, namely Assembly Process Engineer (APE), Test Process Engineer (TPE), Product Engineer (PDE), Manufacturing (MFG), Quality Engineer (QE), and Sales.

The following are examples of the differences between consumer electronics and automotive electronics for each item.

Inspections

For example, in the company where I am working as a consultant, most of the tests are conducted manually, however, the manual tests cannot be quantified and digitized, so the above PAT cannot be executed effectively. Therefore, it is necessary to introduce automated measurement of key steps to make it possible to digitize and quantify it, otherwise there are only 1 (Pass) and 0 (Fail), which it is impossible to apply statistical methods to eliminate the "weak".

Screen Methodology

Generally speaking, the Screening Methodology used in consumer electronics only has an average value (a point), but not a distribution as in Figure 4 PAT, so there is no way to know what is "strong" or "weak".

Therefore, when we enter the automotive electronics, we must apply the concepts of standard deviation and median to distinguish the "strong" and "weak" and further eliminate the "strong" from the "weak".

Low Yield Scrap

In the past, when it comes to yield in consumer electronics, high yielders were sent to high-value customers. While low yielders were also qualified products, so they might be sent to lower-tier customers. However, such an approach is not feasible in automotive electronics, and in order to avoid the risk of large liability claims or litigation in the event of subsequent problems, tools such as PAT and BMY are necessary to understand and thoroughly implement them in the manufacturing process.

SPC Capability

As mentioned above for SPC Control, there is a difference in the level of requirements between the two, with consumer electronics requiring a Cpk of only 1.33, but automotive electronics requiring more than 1.67.

Process Control

In terms of process control, there is no differentiation between automotive and consumer electronics, in general, but in automotive electronics, it must be divided into "general" and "KEY" and more careful control is needed for "KEY," so that resources are invested wisely.

Data Retention

Consumer electronics generally have a three-year lifespan, while manual records are mostly written, which can be problematic in terms of traceability. For example, in the case of automotive electronics, it's not easy to look up data from 15 years ago, so we have to digitize these production records so that these 15 years of records can be more easily maintained in a planned and systematic manner, otherwise it would be a very labor-intensive and time-consuming task not only to retrace but also to interpret them.

Process Traceability

For example, if there is a problem with an end user or a problem with a car user, it would be considered a good performance to find out the root cause of the problem within a few days in consumer electronics. However, in automotive electronics this may not pass scrutiny, because as the saying goes, "a small leak will sink the great ship." If not detected in time will cause great impacts, for example: If the module of a part in the car has a problem, the module problem may affect the screen and the screen problem will become a whole-car problem, forming a series of risks, so the process traceability of automotive electronics must be less than 2 hours, which is why there must be an automated system or a good query system in place. It not only presents the problem, but also helps us to make preliminary judgments and follow-up actions.

Process Path

Process Path, also known as Golden Path, refers to the fact that there are 10 machines that can be used at a certain step and it is necessary to identify the best machine and the worst machine at the beginning. Consumer electronics pay less attention to the quality of the machine, as long as the manufacturing yield can pass the required standards. However, in automotive electronics, the selection of the machine is very important, assuming that 1-2 out of 10 machines are of the best quality and yield, automotive electronics must be produced with the best quality machines (Golden Path/Golden Tools). Without such a process, a large amount of scrap would be generated later on, such as low-yield scrap or under-established screening processes.

Process Change

When looking for the sweet spot in the process to increase the yield, continuous improvement is necessary, for example: improvement of machine availability, optimization of parameters, etc. Consumer electronics regulations are less stringent than those for memory cards. However, in the case of automotive electronics, very stringent change management is required, from inception to implementation to validation of processes, projects, classifications and timelines.

Quality Focus

General consumer electronics usually only need to focus on the customer batch return derived from customer complaints. However, in the field of automotive electronics, a thorough grasp and control must be obtained from the very beginning. For example, after the establishment of PPAP, how does the IPQC (In-process Quality Control) control in the process, how to match the process strengths and weaknesses with the customer's products and formulate a suitable verification plan. Therefore, it is necessary to integrate with the upstream, midstream and downstream of the supply chain to ensure a holistic end-to-end understanding from the source to the final product.

RA / FA Attribute

Consumer electronics focus on FA verification after the quality failure, with the root cause identified. However, as shown in IEEE's Different Quality Requirements (Figure 3), it is necessary to predict whether the final failure will meet the requirement of 0~5ppm of Reliability for automotive electronics, otherwise it will be your own loss in the face of scrapping and customers’ liability claims. Therefore, to avert taking huge losses, we need to change our mindset from passive to proactive and have included an assessment at the beginning when taking on new automotive electronic orders from customers.

Business Process

The business model of consumer electronics is relatively straightforward, usually accepting orders when there is a business and replacing them when customers complain of defective products. On the contrary, automotive electronics covers a very wide range of aspects and the end products alone (such as: car recalls). The impact of compensation is huge, so we need to have a business checklist with our customers to clearly evaluate and prepare for the potential risks before the transaction to mass production.

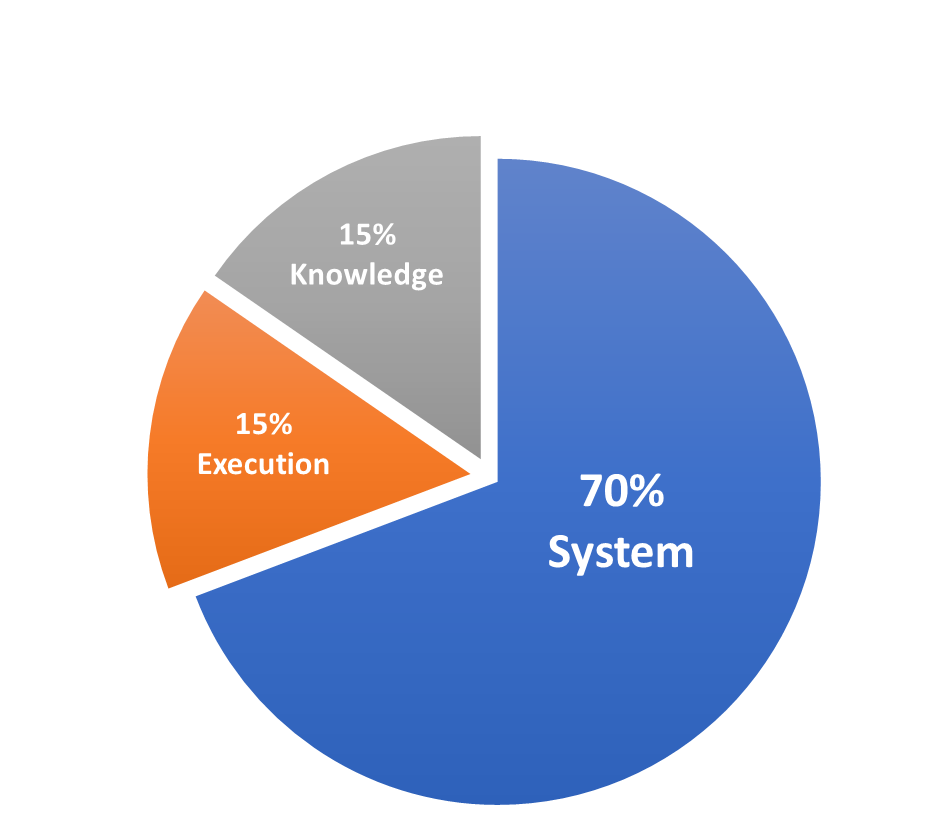

Figure5:Aim to Automotive Business

We can therefore find that in the S (System), K (Knowledge), and E (Execution) of each item in Table 2: The items that need to establish "systems" account for 70%, while "knowledge" and "execution" account for only 15%. Therefore, we can conclude that building a "system" is the key to entering into automotive electronics.

Of course, all S, K, and E need to be evaluated in terms of resources and costs. For example:

1. Specifically, the establishment of a "system" requires a comprehensive plan, calculation and investigation,

2. while "execution" only requires replication and action.

Lastly, "knowledge" requires training.

As long as you have a complete plan, detailed steps, and know what to do and what is missing, it is not a difficult undertaking.

Simply put, items 8-12 in Table 2 can be understood to some extent as simply "execution" and "training." However, items 1-7 related to systems need to rely on electronic, automation system or MES (Manufacturing Execution System) systems, or even change management systems to achieve. Otherwise it could turn out to be a very heavy and inefficient task.

Lastly, we can summarize the whole article into the following 4 points:

1. It is imperative to understand the requirements of relevant regulations before entering into automotive electronics.

2. Specify the operating temperature of the product application.

3. Deploy "System," "Execution" and "Training".

4. Inventory and evaluation of resources and related costs.