By Kate Yuan

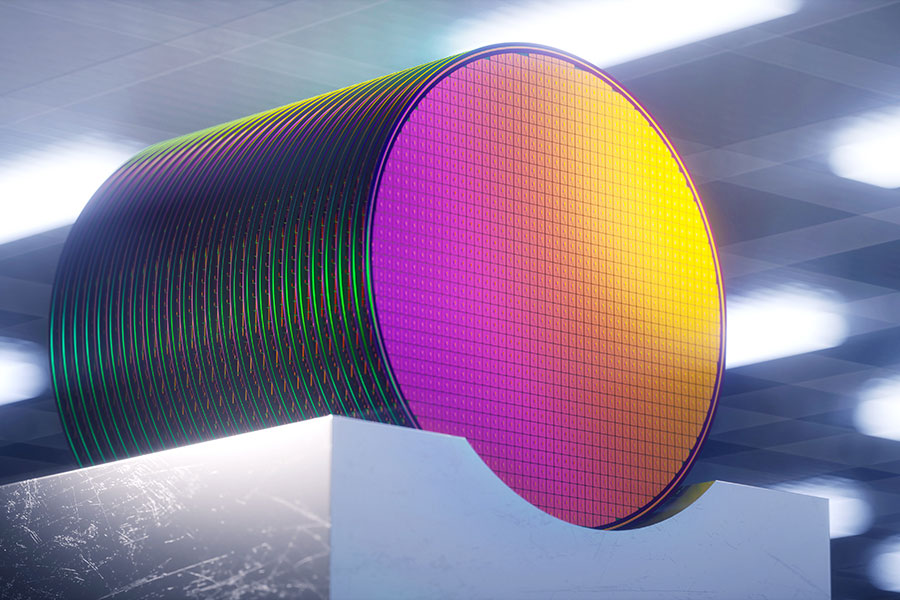

(JW Insights) Mar 3 -- South Korea’s import of silicon wafers from China has continued to grow with this January’s amount hitting $74.882 million, approaching the amount of $77.7 million worth imported from Japan, South Korean media THE ELEC reported on March 2.

The biggest reason for the increase in Chinese wafer imports is price competitiveness, which is about one-tenth that of Japanese products. Wafers imported from Japan cost between $550,000 to $650,000 per tonne, while those from China cost $50,000 to $120,000 per tonne.

In 2020, South Korea’s import of Chinese wafers reached about $424 million, and soared to $563 million in 2021 and $777 million last year. However, the country’s wafer import from Japan decreased to $897 million last year.

The global wafer market is worth about $12 billion, and is dominated by the top five companies, including Japan's Shin-Etsu Chemical Industry, Sumco, Taiwan region's Global Wafers, South Korea's SK Siltron, and Germany's Siltronic.

THE ELEC also said that the number of South Korean engineers working for Chinese fabs is increasing considerably, raising concerns in Korea about technology outflow.

RELATED

-

Local governments in China come up with policies to support AI development in 2023

11-17 19:12 -

NBS: China’s specialized equipment manufacturing industry for semiconductor devices sees 33.9% surge in value added in October

11-17 17:41 -

Investment advisor Nina Xiang: Chinese AI is not a threat in some US imagination

11-15 17:11