By Li Panpan

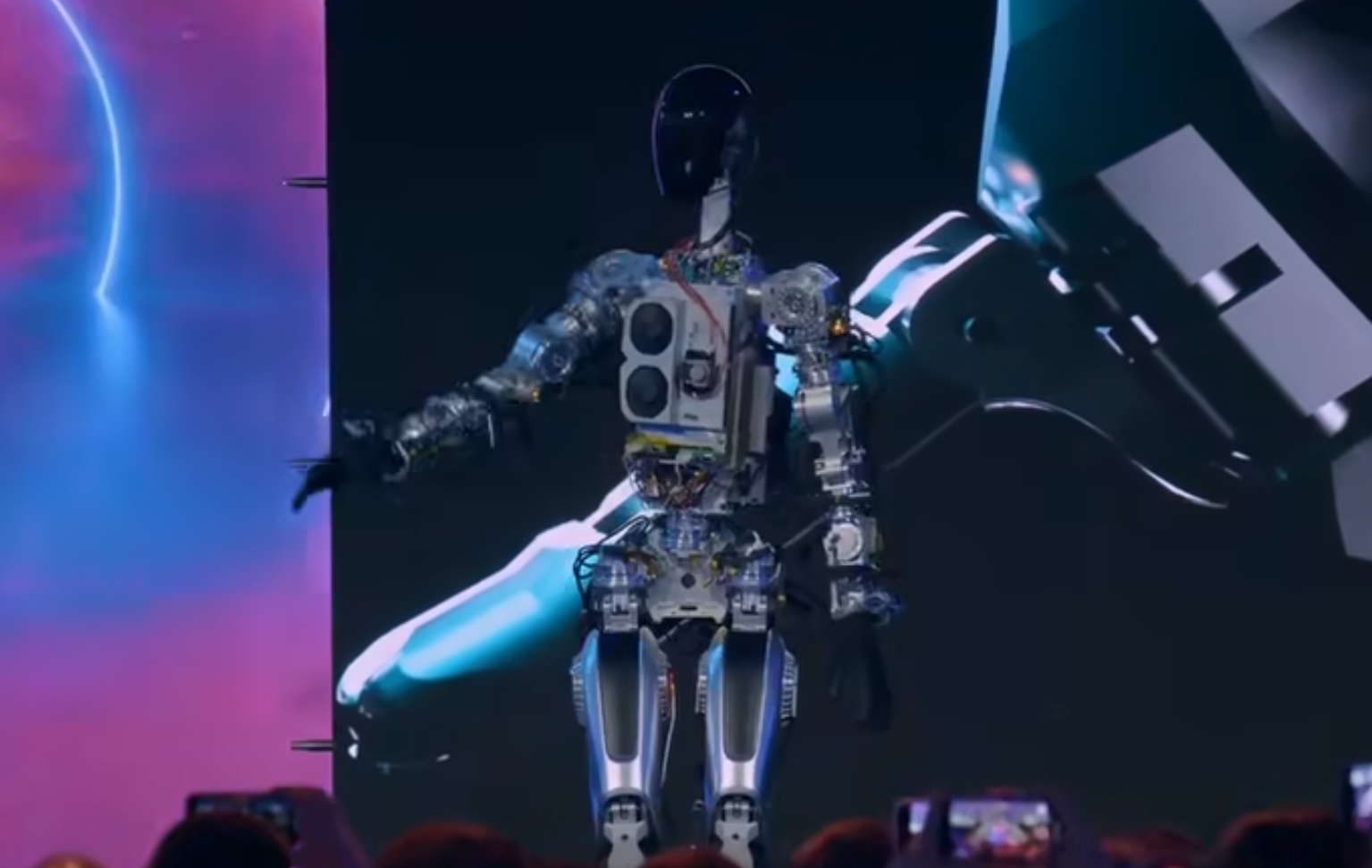

(JW Insights) Jul 24 -- There are 35 Chinese connector manufacturers listed on Chinese stock markets so far this year. They are going after the new opportunities opened up by Tesla-led humanoid robot, JW Insights has learned.

Robotic experts pointed out that as one of the high-value components, connectors are in more and more use for robots to ensure stable, timely, and effective signal transmission is not disturbed, timely and effective. Standard or high-level versions of humanoid robots require more connectors to facilitate the maintenance and removal of wiring harnesses, unlike general industrial robots that do not need many connectors.

Statistics from Bishop & Associates show that the global connector market grew by more than $6 billion in 2022, up by 7.8% year-on-year, and is expected to exceed $90 billion in 2023.

It is estimated that the Tesla-led humanoid robot market may reach RMB449.6 billion ($62.50 billion) after its accelerated penetration in 2030, and the new market value it creates in 2030 is at RMB45 billion ($6.26 billion).

In the Chinese market, manufacturers such as Xiaomi also have a layout in the field of robots. Based on this calculation, the market scale of Chinese robot connectors may exceed RMB45 billion ($6.26 billion) in 2030.

Chinese connectors manufacturers include Recodeal, Dingtong Precision, Electric Connector Technologies (ECT), Wcon Electronics, CNEV, Yonggui Electric Equipment, CZT, Luxshare ICT, Poway Alloy, CARVE, YDET, and Laimu Electronic, to list the leading one. And those with technology accumulation and production capacity advantages may be the first to benefit.

Deren Electronics, EWPT, Luxshare Precision, and Wcon Electronics are developing robot connector samples for Tesla. Wcon Electronics mainly made car connectors before.

Chinese connector manufacturers are also trying to expand from the home appliance or consumer electronics market to higher-value automobiles, industrial robots, and other fields.

The requirements of humanoid robot connectors are higher than those for automobiles and industrial robots. The main differences lie in the loss rate of signal transmission, shielding, stretching, and folding capabilities, noted an industry insider.

With lower thresholds in production design and materials in the connector market, there are quite many Chinese connector manufacturers now. But some of their products can only be used in industrial robots. There are very few manufacturers that meet the requirements of humanoid robots.

Fortunately, humanoid robots are still in the early stages of development, and Chinese manufacturers still have opportunities for trial and error.