By Li Panpan

(JW Insights) Jul 31 -- The global market share of China's lithium battery anode materials has increased from 96% in 2022 to 97% in the first half of 2023, said a report by ICC, a Chinese consulting agency focusing on the industry.

The global shipment of lithium battery anode materials in the first half of the year was 748,000 tons, a year-on-year increase of 17.4%, said ICC.

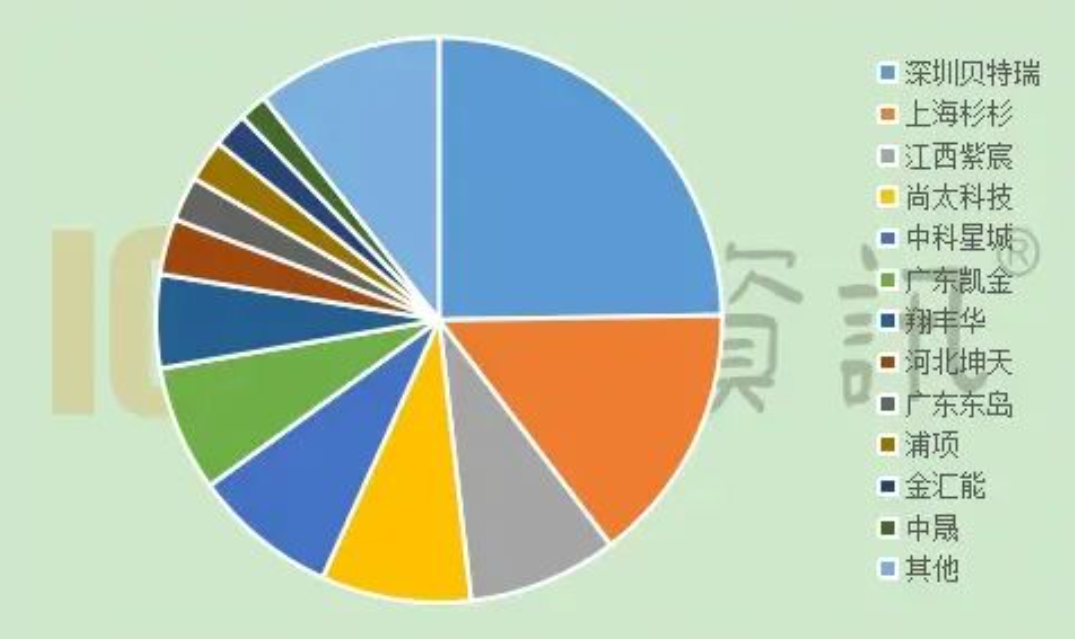

Shenzhen-based BTR (贝特瑞) accounts for about one-quarter of the global share during the time and continues to lead the global lithium battery anode material industry. The company has ranked first worldwide regarding anode material shipments for ten consecutive years since 2013.

Other companies listed in the top 12 are Shanshan Technology, Zichen Technology, Shangtai Technology, Zhongke Shinzoom, Kaijin Technology, XFH Technology, Kuntian Technology, Dongdao Technology, Posco, Jinhuineng New Materials, and Zhongsheng New Materials, said the report.

Among the top 12 companies, 11 are from China, and Posco is based in South Korea. There are no details on Posco's market share released by ICC, but judging from ICC's global competition pattern chart, its proportion is very low.

ICC predicted that the global output of lithium battery anodes will reach 2.9 million tons in 2025, and the demand for raw materials is as high as 3.5 million tons. In the next two to three years, the resource layout on the raw material side will be essential for anode material companies.

Citing ICC's data analysis, BTR said that, on the whole, the high global penetration rate of China's anode materials would not change in the short term. The new production capacity of anode materials in countries other than China will be released mainly around 2025. In a short time, anode materials will continue to grow in the second half of the year, and there might be a significant increase, especially around the end of the third quarter.

In fact, China occupies an essential position in the entire global power battery and lithium battery industry chain, not just in anode materials.

In power batteries, among the top ten global companies, six are Chinese, namely CATL, BYD, CALB, Guoxuan Hi-Tech, EVE Energy, and Sunwoda.

In cathode materials for lithium batteries, the market share of Chinese companies also ranks first in the world. Their market share was 31.3% in 2022, followed by Japan, South Korea, and the United States, according to Chinese data company Zhihuiya,

In electrolytes, the supply of Chinese electrolyte companies accounted for 85.2% of the world's total in 2022, with seven listed in the top ten global companies by shipments, according to the statistics of ICC.

Chinese companies are also very competitive in diaphragm, one of the four primary materials of lithium batteries. As of the first half of 2022, China, South Korea, Japan, and the United States accounted for 43%, 28%, 21%, and 6% of the world's market share, respectively.

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26 -

GE Healthcare's new Shanghai Innovation Center hosts first batch of digital health startups

11-17 19:11

READ MOST

No Data Yet~