By Li Panpan

(JW Insights) Sep 19 -- More than 15 Chinese electronic gas manufacturers have gone public for more market share and growth. However, the market is in oversupply with price wars, JW Insights reported.

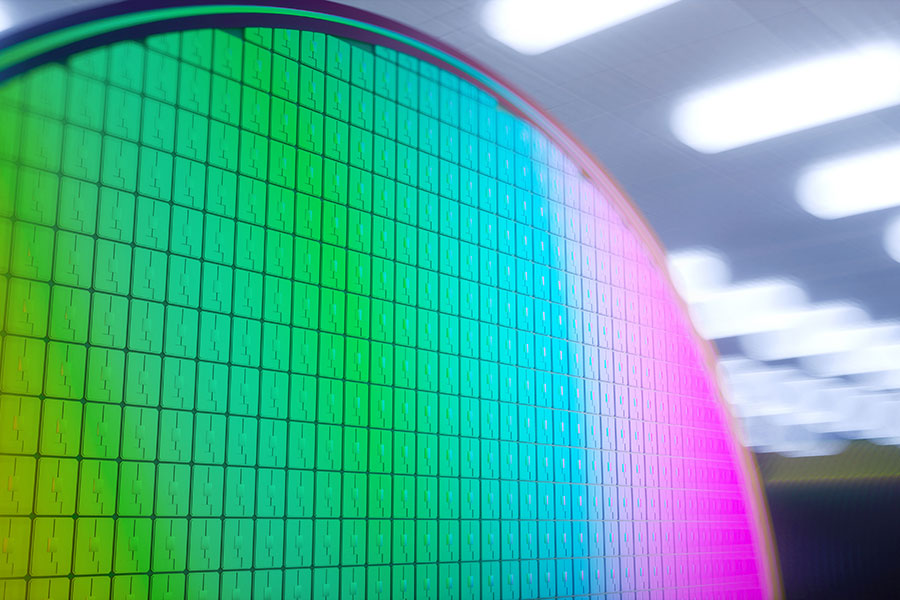

Electronic gases, the second-largest semiconductor material in market demand following large silicon wafers, account for 14% of the semiconductor material market. They are widely used in ion implantation, etching, vapor deposition, doping, and other processes in IC manufacturing.

Like in many semiconductor product markets, large international companies occupy firmly in this market. They include Air Chemicals, Air Liquide, Taiyo Nippon Sanso Co., Ltd., Praxair Group, and Linde Group.

However, long-term dependence on imports has caused increasingly more problems, such as high product prices, long delivery cycles, and untimely services. This has become a technical bottleneck for strategic emerging industries like the country's semiconductor industry.

With geopolitical changes and the impact of the pandemic, the Chinese industry felt it urgent to localize the electronic gas market and is speeding up to ensure supply chain safety.

There are more than fifteen A-share listed manufacturers focusing on the electronic gas market, including Peric (中船特气), Haute Gas (华特气体), Jinhong Gas (金宏气体), Nata Opto-electronic Material (南大光电) and Kaimeite Gases (凯美特气).

At the same time, other local electronic gas manufacturers, including Deer Technology, Credit Chemistry, and Ling Gas, have also started their process to go public and seek greater development.

However, the overall market size of electronic gas is not significant. It reached $5.001 billion in 2022, a year-on-year growth of 8.43%. The size of China's electronic gas market was RMB23.1 billion ($3.17 billion) in 2022, a year-on-year increase of 6.94%, according to data from the China Semiconductor Industry Association.

In 2022, the combined revenue of the electronic gas business of several leading manufacturers has reached RMB5.8 billion ($795.12 million), accounting for 25.1%, achieving the initial role of domestic substitution.

Since 2023, the supply of upstream raw material rare gases has exceeded demand, and the sales prices of electronic gas products have also dropped. Therefore, the capacity utilization rate of major wafer fabs is insufficient, and some manufacturers have fallen below 60% in revenue size. It inevitably affected the first half of 2023 performance of manufacturers such as Peric, Haute Gas, Nata Opto-electronic Material, and Yoke Technology.

A large number of electronic gas manufacturers have worked supplying nitrogen trifluoride, tungsten hexafluoride, ammonia, carbon tetrafluoride, and sulfur hexafluoride for their larger usage and higher economic value.

However, the homogeneity of product varieties and technical grades has caused an oversupply and price war in the nitrogen trifluoride market.

An industry insider pointed out that many types of special gases are required by wafer fabs, with enormous demands. Currently, 80% of the varieties on the market are in the hands of international suppliers. Chinese manufacturers should make breakthroughs in different types of gases.

Among more than 110 electronic gases, many products are unavailable in China. However, some have small market sizes. They may not justify the costs of capital and time required for research and development. So, they are more willing to compete in those with significant market demand.

RELATED

-

Chinese top-tier chipmaker HuaHong Semiconductor's net profit plummets 86 percent in the third quarter

11-17 19:11 -

Chinese MEMS provider Fatri UTC will set up its sensor chip production plant in Shanghai

11-16 18:30 -

China's packaging and testing services provider Forehope Electronic will build a new plant with RMB2.157 billion investment

11-15 17:17

READ MOST

No Data Yet~