By Greg Gao

Chinese connector manufacturers for the EV sector are trying to gain a foothold in a market traditionally dominated by international connector giants amid the flourishing EV industry and a sweeping localization trend in China, JW Insights reported recently.

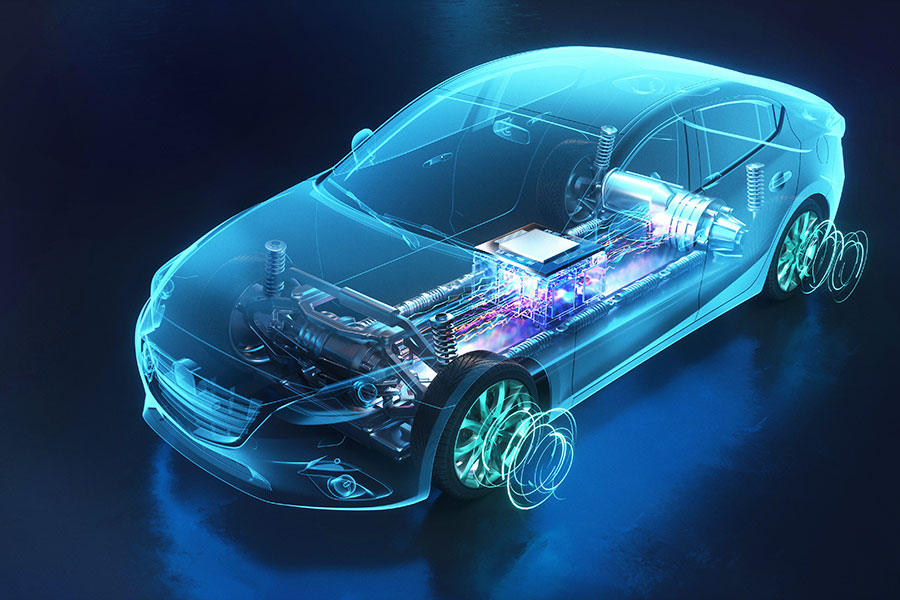

The rapid development of electric vehicles has brought significant changes to the auto industry. The automotive industry's transformation toward electrification disrupted the entire supply chain and created a significant shift in market size for automotive components. Critical components for electrification such as batteries, electric drives, cable connectors, and autonomous driving see a significant increase.

A teardown analysis report of the Tesla Model 3 released recently by CITIC Securities showed that EV cable and connector cost increased substantially. An industry insider pointed out that the value of the high-voltage connectors in some new energy vehicles has reached more than RMB3,000 ($438).

EV cable connectors are not the traditional strength of the Chinese local suppliers. According to published industry information, the top ten automotive connector suppliers are all international titans. However, as the EV industry booms in China and Tesla's 'catfish effect' is propelling China's local EV makers and supply chain forward, the localization of connectors is accelerating.

A number of representative connector enterprises have emerged, such as Recodeal (瑞可达), Zhejiang Yonggui Electric Equipment(永贵电器), Suzhou Chilye(智绿环保), Shenglan Technology(胜蓝股份), and Electric Connector Technology(电连技术).

The connector is an indispensable device in the car, mainly used for the internal connection of the automobile. With the burgeoning of automobile electrification and intelligence, the connector market has undergone new changes. The increasing adoption of batteries, in-vehicle multimedia, in-vehicle infotainment, and sensor integration unleashed a lot of demand for the connector.

Automotive connectors are mainly divided into low-voltage/low-speed connectors, high-voltage connectors, and high-speed connectors. The low-voltage/low-speed connectors are mainly used in ECUs and sensor devices, and their value is not very high.

An industry insider pointed out that the value of high-voltage connectors for electric vehicles ranges from RMB700($102) to RMB3,000($437). Data from Huaxin Securities' research showed that the value of high-voltage connectors for electric passenger vehicles and commercial vehicles is about RMB 1,600($233) and RMB6,000 ($874), respectively. The market size is expected to increase from RMB6.5 billion ($947 million) in 2021 to RMB22.9 billion($3.33 billion) in 2025, with a compound annual growth rate of 29%.

Recodeal has become one of the local leading enterprises of high-voltage connectors for electric vehicles, holding a market share of about 11%.

High-speed connectors are mainly used to meet applications such as automotive assisted driving, automatic driving, and the Internet of Vehicles. They are very common in cameras, T-BOX, domain controllers, Lidar, antenna, displays, and other scenarios.

China's automotive connectors are still mainly supplied by established international giants. Statistics from the industry research company Huaon show that the top ten companies in the market are mostly U.S., Japanese, and European companies, such as TE Connectivity, Yazaki, Aptiv, JAE, Rosenborg, of which the top three companies account for about 70% of the global market share.

It is widely believed among Chinese companies sthat they till have great opportunities in high-voltage and high-speed connectors, driven by the electrification of automobiles. Currently 4ra number of local startups have emerged and are developing rapidly.

For example, in the field of high-voltage connectors, the AVIC Jonhon OptronicTechnology(中航光电), Recodeal (瑞可达), Zhejiang Yonggui Electric Equipment(永贵电器), Suzhou Chilye(智绿环保) have been at the forefront of localization.

Sailtran Electronics(赛川电子) and Mind Electrical System(曼德电子), which are backed by China's largest bus manufacturer Yutong Group and leading automobile manufacturer Great Wall Motor respectively, also have deep technical reserves.

In addition, Shenglan Technology(胜蓝股份), Sichuan Huafeng Enterprise(华丰科技), Guizhou Space Appliance(航天电器), Luxshare Precision(立讯精密) are also rapidly deploying connector business in the field of new energy vehicles.

For high-voltage connectors, local Chinese companies have advantages in the low current connector, EV charging connector, and OEM processing. However, in the high current connector, there is still a considerable gap for Chinese manufacturers to catch up, an industry analyst said.

Compared with the rapid growth of high-voltage connectors, the localization process of domestic high-speed connectors is relatively slow in China. Since high-speed connector manufacturers need to have communication and radio frequency technology R&D ability, there are fewer companies involved in this field.

Chinese companies in this field mainly include Electric Connector Technology(电连技术), LJV(林积为), SUNNET(中聚泰), HuLane(胡连).

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26

READ MOST

No Data Yet~