By Li Panpan

US sanctions are minimally working but only serve as a catalyst for China to promote its drive for self-sufficiency in chip making, said Robert Castellano, president of The Information Network, in a published article on January 3 in the US website Seeking Alpha (https://seekingalpha.com/).

“The US semiconductor sanctions are proving to be a catalyst for enhanced China growth. A slowdown in China chip production was more a result of pandemic lockdowns than sanctions last year,” said Castellano.

The only winners in these sanctions to date have been Chinese Equipment companies. The mean growth for non-Chinese companies for the nine-month period between January 2022 and September 2022 was 11.2%, and Applied Materials (AMAT) exhibited a revenue growth of just 8.7% for 3Qs 2022 vs. 3Qs 2021, indicating underperformance against other non-Chinese WFE competitors, while the growth for Chinese equipment companies was 62.8%, indicating that Chinese equipment companies are gaining in the market, although their revenues are significantly lower than non-Chinese counterparts, said Castellano.

Equally important, the top eight Chinese equipment companies all sell products that compete directly against AMAT.

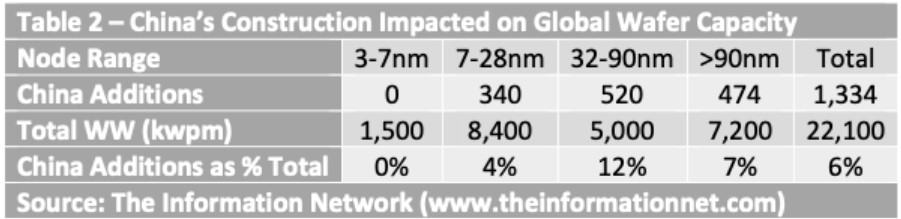

The table above shows planned fab construction in China between 2022 and 2025 for chip construction at the 28nm node and above. These fabs are primarily foundries, a model that has been embraced in China because of the success of SMIC. Total fab spending is $67.566 billion.

This table sums up the impacts of the China fab additions, which increases China’s total by 6%, but with a 12% growth impact at the 32-90nm node range. At the much-ballyhooed 28nm node, China additions from SMIC will account for just a 4% increase.

“If the Reuters article about an RMB1 trillion ($142 billion) investment in fabs by the Chinese government is correct, it can be assumed that a fab spend of $142 billion, which is 2X the current fab spend, will be 2X the impact on the global capacity. Thus, China additions would add 12% to the global capacity,” said Robert Castellano.

“This small growth is another indication that U.S. sanctions are minimally working but only serve as a catalyst for China to promote its drive for self-sufficiency in chip making. This expansion in fabs follows an expansion of Chinese chip companies in purchasing fab equipment from Chinese companies, added Castellano in the Seeking Alpha article.

RELATED

-

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese top-tier chipmaker HuaHong Semiconductor's net profit plummets 86 percent in the third quarter

11-17 19:11