(JW Insights) Mar 17 -- China’s driverless technology startup Guangzhou WeRide Technology(文远知行) has filed confidentially for an initial public offering in the US and is looking to raise as much as $500 million, Bloomberg quoted people familiar with the matter as saying on March 13.

The startup is working with advisers on a potential listing that could take place as early as the first half of this year.

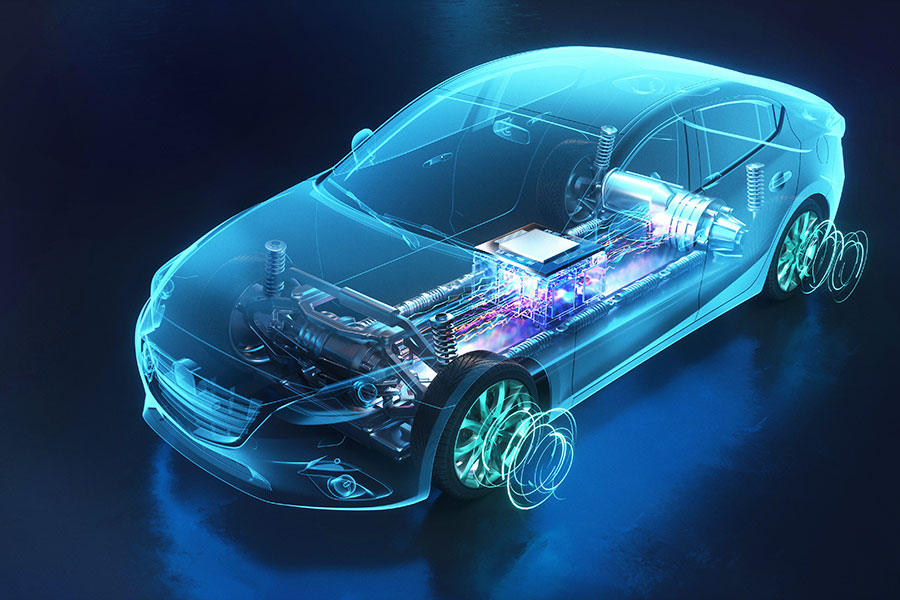

Founded in 2017 and headquartered in Guangzhou, WeRide develops autonomous driving technology and is testing the technology in over 25 cities around the world, its website shows. WeRide produces vehicles, including robotaxis, mini buses, vans, and street sweepers, in addition to its autonomous driving software and hardware solutions.

The company has formed strategic partnerships with leading global OEMs and Tier 1 suppliers, including Renault-Nissan-Mitsubishi Alliance, Yutong Group, GAC Group, Bosch, etc.

WeRide launched its brand new sensor suite WeRide SS 5.1 for L2+/L3 advanced driver assistance applications at CES 2023 on January 5. Based on multiple sensor sets, WeRide SS 5.1 integrates high-resolution semi-solid LiDAR, blind spot LiDAR, and high-precision cameras, providing a 360-degree Field of View (FoV) with a front detection range of up to 200 meters. This sensor suite can also be adapted to L4 autonomous driving with its excellent perception capabilities.

The Chinese autonomous driving startup has been racking up hefty investments of more than $1.5 billion in the past few years to fuel its technology development and fleet deployment. Its valuations have also skyrocketed as self-driving remains one of the few sectors that excites startup investors. WeRide’s valuation jumped to $3.3 billion when it completed its Series C round.

It reportedly pulled in a new round in March 2022, with investors including GAC Group, Bosch, and Carlyle, lifting its valuation to $4.4 billion. In November of the same year, WeRide received another investment from China Development Bank and other institutions, with a post-investment valuation of $5 billion, said the Bloomberg report.

(Gao J)

RELATED

-

Chinese leading Wi-Fi FEM provider Kxcomtech debuts on Shanghai Stock Exchange STAR Market with a 178.67% surge on the first day

11-17 14:13 -

Senior IC institutional investor Chen Yu points to more opportunities in AI chips and equipment in 2024

11-16 16:12 -

Chinese GPU startup Moore Threads completes B+ round of funding

11-16 15:17

READ MOST

No Data Yet~