By Kate Yuan

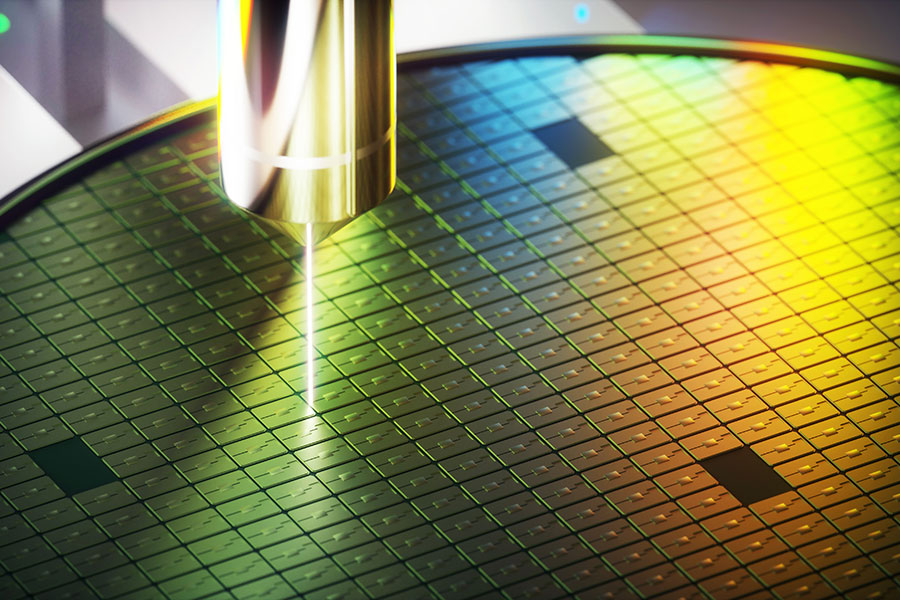

(JW Insights) Jul 10 -- The market share of the Chinese mainland foundries in terms of 12-inch wafer production capacity will likely increase from 24% in 2022 to an estimated 26% in 2026, despite facing export controls from the US, Japan, and the Netherlands, said the Taipei-headquartered global technology research company TrendForce on July 5.

It added that if the exports of 40/28nm equipment eventually receive approval, there’s a chance that this market share could expand even further, possibly reaching 28% by 2026. This growth potential should not be dismissed.

On June 30, the Netherlands introduced new export restrictions on advanced semiconductor manufacturing equipment. Several manufacturing processes including photolithography, deposition, and epitaxy will be subject to these recent export restrictions. Beginning September 1, the export of all controlled items will require formal authorization.

TrendForce reports that Chinese foundries have been primarily developing mature processes like 55nm, 40nm, and 28nm. Furthermore, demand for deposition equipment can be largely met by local Chinese vendors, meaning concerns regarding expansion and development are minimal. The main limiting factor, however, remains the equipment used in photolithography.

The businesses in China to be impacted first include SMIC’s Beijing and Shanghai fabs, as well as Nexchip’s A3/A4 fabs in Hefei. TrendForce assesses that Nexchip’s Hefei fabs may experience far less disruption, as their short-term production focus remains on more mature processes. Conversely, SMIC’s Beijing and Shanghai fabs may be forced to delay their expansion plans, pending permission for their equipment vendors to proceed with shipments.

The US Export Administration Regulations (EAR) is primarily aimed at limiting China’s growth in advanced process, rather than mature ones. Although export regulations from the US, Japan, and the Netherlands cover equipment used across both mature and advanced process generations, it’s namely equipment used in 45nm to more advanced processes which will require inspection.

However, mainstream equipment for mature processes ranging from 45–28nm could potentially still require export authorization as well. Even though Chinese foundries will likely face a lengthy equipment review process, forcing them to delay their expansion plans for 40nm and 28nm processes, their ambitious positioning in the 28nm market ensures their development pace remains strong.

It’s worth noting that, while advanced processes such as 1Xnm are currently not the primary focus of Chinese foundries, China’s potential for further development in this area is anticipated to face increased obstacles with the enforcement of more comprehensive export regulations, according to TrendForce.

RELATED

-

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese top-tier chipmaker HuaHong Semiconductor's net profit plummets 86 percent in the third quarter

11-17 19:11

READ MOST

No Data Yet~