By Kate Yuan

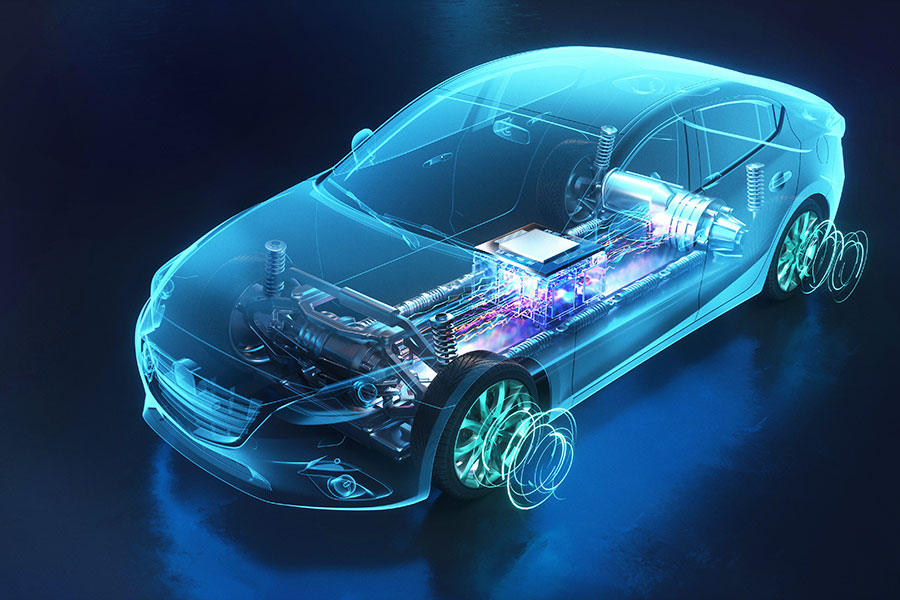

(JW Insights) Aug 21 -- The market size of China's new energy vehicles (NEVs) is expanding and the boom is giving Chinese chipmakers new historic opportunities as well as challenges, according to a recent JW Insights report by analyst Chen Bingxin. Excepts of the article is as follows.

In the first half of this year, the penetration rate of new energy vehicles (NEVs) in China reached 28.2%, said Xu Changming, deputy director of the State Information Center at the 7th “Chip Power Beijing” Zhongguancun IC Industry Forum. This means that one out of every four cars sold is a NEV.

In the future, NEVs will continue to experience rapid growth. On the one hand, leading automakers continue to maintain high profits. Tesla's per-vehicle profit hit $5,799 in H1 of 2023 and that of BYD was RMB8,362 ($1,152). On the other hand, China's NEV industry supply chain is more complete and robust.

The intelligence trend in the automotive industry driven by AI has led to a strong demand for automotive chips. The global auto chip market was valued at approximately RMB310 billion ($42.75 billion) in 2022, and it is expected to exceed RMB600 billion ($82.75 billion) by 2030. This will bring new market opportunities for China's chip industry.

Ren Xiang, director of the Integrated Circuit Evaluation Center at the China Electronics Standardization Institute, said that in 2022, automotive applications contributed 13.7% to the global IC market and 21.8% growth. It is estimated that by 2035, the auto semiconductor market will take up over 30% of the global semiconductor market.

Currently, over 100 Chinese companies are engaged in developing and producing auto chips, including SoC, FGPA, and RISC-V CPUs. Over 50 listed chip companies claim to have car-grade products or mass-produced applications, according to data from the China Automotive Chip Industry Innovation Strategy Alliance.

Despite the broad market prospects, Ren Xiang reminds Chinese chip companies of the challenges while catching the opportunities.

Auto chips usually require high reliability with complex design, long testing cycles and high material costs. They are mostly based on mature processes but often integrate many advanced technologies, many of which are related to safety. Automakers have strict requirements in this regard. Besides, these chips often use specialized processes, which come at a high price.

“China should focus on promoting cooperation between the upstream and downstream sectors when advancing the development of the auto chip industry. Multiple parties should work together to advance industrial development,” said Ren Xiang.

“Currently, automakers have gradually begun to accept domestic chip companies and even directly invest in their research and development. At the same time, domestic fabs also have intentions to invest in car-grade processes,” Ren added.

Ren Xiang emphasized the importance of EDA tools for automotive chips as well. “There is an increasing demand for safety and reliability in automotive design, and the systematic verification of EDA tools plays a significant role in ensuring intrinsic safety. The trend is shifting from reliability verification in testing to design verification on reliability.

China’s EDA industry has made certain achievements. It can provide full-process platforms capable of supporting 14nm designs, and has addressed initial challenges in analog and digital EDA toolchains for 7nm and beyond. Moreover, over ten domestic tools have reached international leading levels.

However, basic data standards are still controlled by U.S. companies, and there is a lack of relevant testing standards domestically. Therefore, in the next stage, efforts should focus on guiding car-grade processes and EDA tools to develop targeted applications for automotive special requirements.

In addition, building a third-party testing and certification platform and independent unified standards for automotive chips are crucial guarantees for the adoption of domestic chips in vehicles, concludes the JW Insights article.

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26

READ MOST

No Data Yet~