(JW Insights) Sept 4 -- Europe's carmakers have a fight on their hands to produce lower-cost electric vehicles (EVs) and erase China's lead in developing cheaper, more consumer-friendly models, executives said at Munich's IAA mobility show, reported Reuters on September 5.

"We have to close the gap on costs with some Chinese players that started on EVs a generation earlier," Renault CEO Luca de Meo told Reuters at the car show, adding when manufacturing costs decline, prices will also go down.

De Meo said as part of the French carmaker's drive toward price parity with the Chinese, its R5 EV due out next year will be 25% to 30% cheaper than its electric Scenic and Megane models.

Chinese EV makers, including BYD, Nio and Xpeng are all targeting Europe's EV market, where sales soared nearly 55% to about 820,000 vehicles in the first seven months of 2023, making up about 13% of all car sales.

Xpeng plans to expand into more European markets in 2024, and Zhejiang Leapmotor Technology announced five models for overseas markets, including Europe, over the next two years.

According to auto consultancy Inovev, 8% of new EVs sold in Europe so far this year were made by Chinese brands, up from 6% last year and 4% in 2021.

About 41% of exhibitors at this year's Munich event are headquartered in Asia, with double the number of Chinese companies attending, including BYD, Xpeng and battery maker CATL.

The average EV in China cost less than 32,000 euros ($35,000) in the first half of 2022 compared with around 56,000 euros in Europe, according to researchers at Jato Dynamics.

"The base car market segment will either vanish or will not be done by European manufacturers," BMW CEO Oliver Zipse said on Sunday evening in reference to China's push into Europe.

Xpeng President Brian Gu said while European carmakers currently lag behind China, they have made a "huge commitment" to EVs with partnerships and large investments in technology.

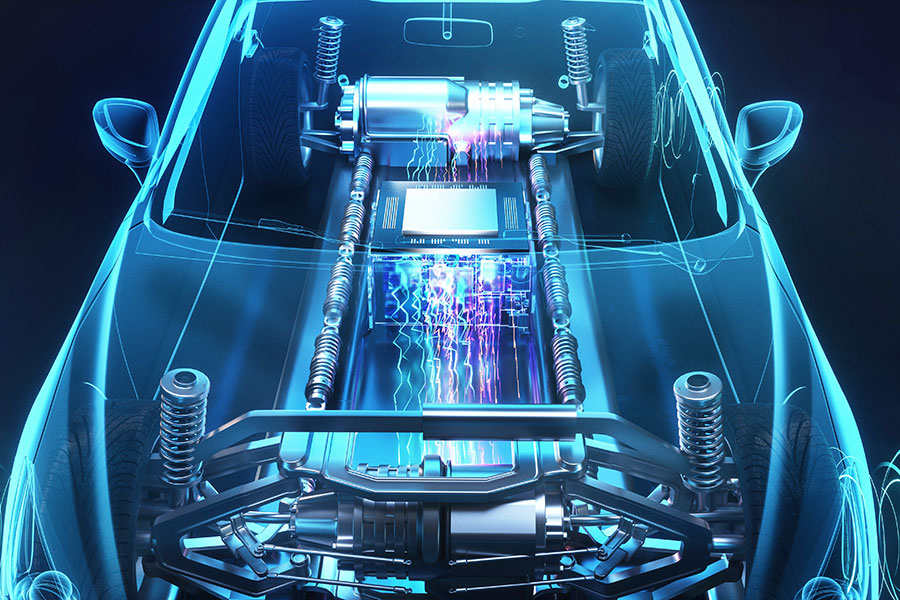

Auto industry analyst Ferdinand Dudenhoeffer said the Chinese are "world champions" at making batteries, which can make up 40% of an EV's cost.

Chinese battery makers setting up in Germany are helping to lower EV costs and German politicians need to make sure they are "not driven out of the country with stupid decoupling strategies," Dudenhoeffer added, according to the Reuters report.

(Gao J)

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

Chinese auto giant Changan Automobile plans to launch eight self-developed battery cells in the future

11-20 16:26

READ MOST

No Data Yet~