By Li Panpan

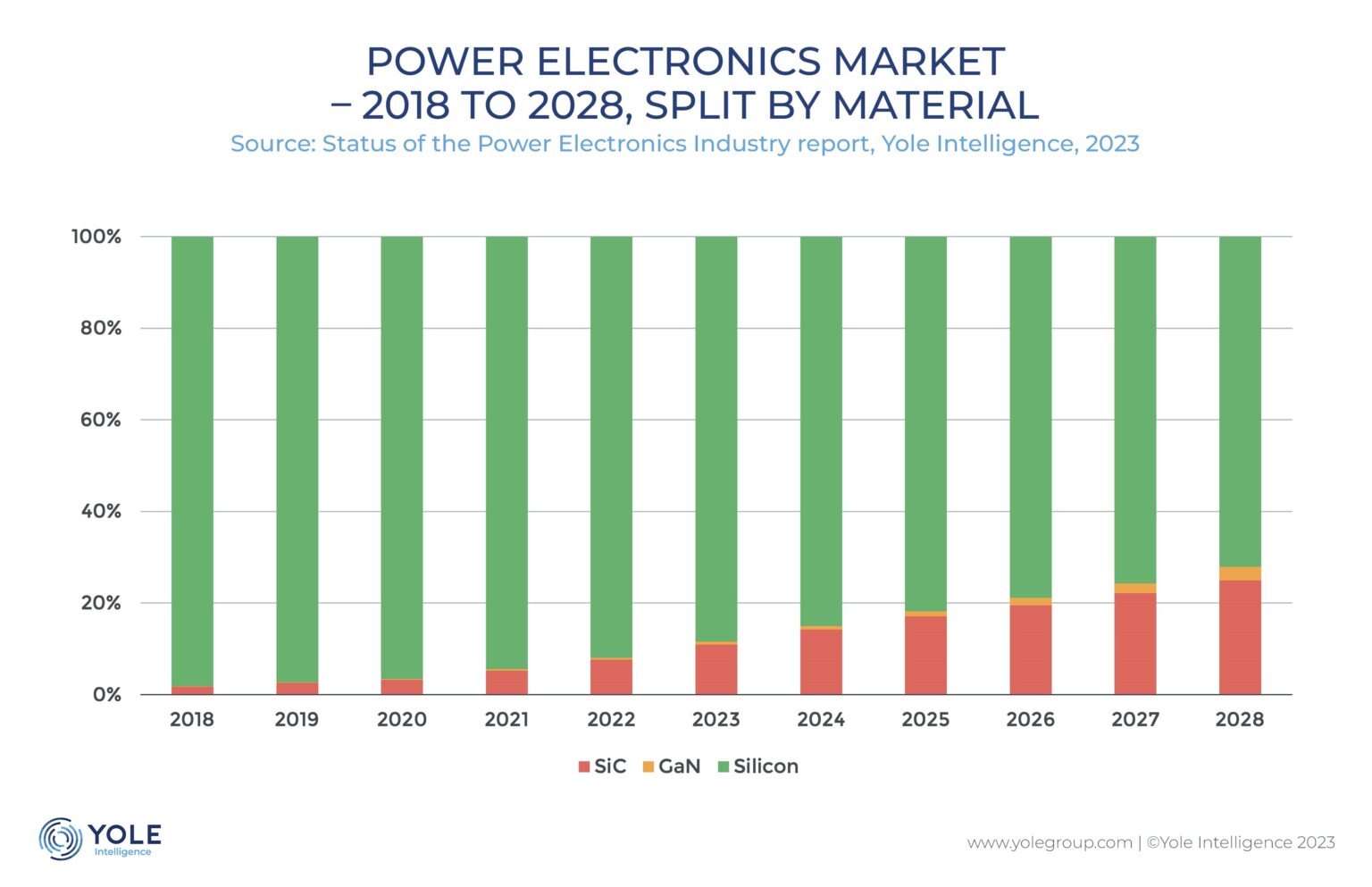

(JW Insights) Oct 31 -- Driven by electric and hybrid electric vehicles (xEVs), renewables, and industrial motors, the total power device market is expected to grow rapidly from about $23 billion in 2023 to $33.3 billion by 2028. Chinese companies are expected to ramp up quicker than European or US companies in 2024-2026 to manufacture for the local EV market, said Yole Intelligence on October 26.

This calls for building up new manufacturing capacities. Strategic investment decisions will be based on existing capacities and expected device volume needed and the silicon, SiC, and GaN shares in various applications.

Ana Villamor, team lead analyst of power electronics at Yole Intelligence, said, “We are expecting an addition of 25 million 8’-inch equivalent wafer starts per year (WSPY) in the next five years, based on the announcements made by the companies on top of the existing 56 million WSPY already in place. This is a very large investment cycle, the largest ever in the power electronic industry.”

Both Integrated Device Manufacturers (IDMs like Infineon, Bosch, Toshiba, Nexperia, CR Micro.) and foundries (SMIC and HHGrace) have taken the decision to move to 300 mm wafers. Some players, such as Infineon, Alpha & Omega, Bosch, onsemi, and Silan, already have 300 mm production, while others, including STMicroelectronics, are starting volume production in 2023, and more companies will start in 2024-2026. Other players will follow suit, including many Chinese companies ( BYD with massive investment, for example), said Yole Intelligence.

In the case of SiC, big players operate across the entire supply chain, with smaller players from China, such as TankeBlue and SICC, in the SiC boule/substrate space. Chinese companies are progressively gaining market share at the SiC wafer level, and have planned significant capacity in the coming five years, targeting more than 40% of the total capacity in 2027.

Depending on a factory's utilization rate, production yield, and wafer quality, SiC wafers may thus become largely available and offered at lower prices from Chinese suppliers.

Such a reversal of SiC wafer demand/offer situation would modify to great extend the rules of the game in the SiC and silicon device businesses. The availability of cheaper SiC devices would not only impact SiC players with high-cost structures but would also accelerate SiC device adoption in many applications as an alternative to silicon devices, according to the Yole Intelligence report.

RELATED

-

The IC design subsidiary of China’s listed IC distributor P&S completes testing of its first MCU product for automotive standard

11-20 16:26 -

Chinese electronic component company CETC mass produceds its Beidou satellite communication module for China’s major EV maker

11-20 15:55 -

China’s PC maker Lenovo will launch AI-powered PCs after reporting strong revenue growth

11-17 16:04

READ MOST

No Data Yet~