By Miranda Li

Leading Chinese automakers, including BYD, NIO, Xpeng, and Wuling, are applying SiC instead of IGBT in their medium and high-end vehicle models. The SiC price is expected to be lowered to an acceptable level in the next four to five years, JW Insights reported.

As the critical incremental devices for automotive electrification, power devices have grown rapidly in the booming downstream market in recent years. IGBT and SiC are the representatives of the second-and third-generation power devices, respectively.

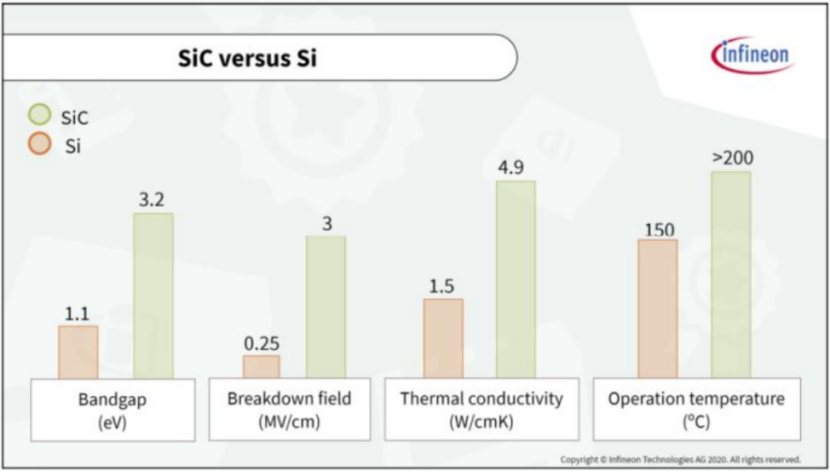

Compared with IGBT, SiC has evident advantages in the wide band gap, breakdown electric field, thermal conductivity, and working temperature, as the following figure shows. Influential OEMs have planned IGBT and SiC applied car models simultaneously.

Comparison of four critical properties of SiC and Si-based materials (Source: Infineon)

Based on the data revealed by the PSIC forum, compared with IGBT, the SiC component has a volume of a third of the volume of the IGBT component, weighing 40% less. The power consumption of SiC applications under different working conditions can be reduced by 60%. Insiders believe that the substitute of SiC for IGBT can improve the inverter efficiency by 3-8%. “In the future, SiC will replace IGBT as the trend develops,” said Liu Bo, the chief engineer of the VREMT electrical project. Vehicles with SiC applications could achieve a 3% -5% increase in driving mileage, he added.

The demand for fast charging and the long-term endurance of electric vehicles is also accelerating the development of SiC devices. SiC’s strong withstand voltage capability makes it a new choice for high-voltage charging platforms.

The market research agency Yole predicts that driven by the strong EV market, the SiC market is expected to increase rapidly from $1 billion in 2021 to $7 billion in 2027, providing a strong growth momentum for the companies in the SiC industry chain.

The models with SiC devices applied include Tesla Model 3, BYD Han, NIO ES7/ET7/ET5, Xpeng G9, Smart #1, Wuling Victory Hybrid, and Wuling Asta Hybrid.

Chen Dongpo, deputy general manager of San’an Optoelectronics (三安光电), said that SiCs will be introduced into long-range EV models from 2023 to 2024, with a penetration rate up to 40%.

Driven by the bright market prospect, China’s SiC industry chain enterprises have continuously increased investment in their technologies and planned the market layout in recent years.

The SiC market has become more dynamic since 2022. USI(环旭电子) has started the mass production and shipment of SiC inverters. VREMT(威睿电动) completed 200kW SiC electric drive assembling on June 21. BYD semiconductor launched a new 1200V 1040A SiC Power module. Top Electronics(芯塔电子) has completed Angel round financing for localization of automotive-grade SiC MOSFET.

Ascen Power(芯粤能) is accelerating the 6-inch and 8-inch SiC wafer projects — 240,000-piece capacity per project is scheduled to be put into production by the end of May 2023. CATL, a Chinese leader in power batteries, also entered the SiC field by investing in MITK SEMI.

Other companies that are developing SiC-related technologies and products include China Resources Microelectronics, San’an Optoelectronics, Star Power, SHINRY, Tony electronics, and NCE Power.

The price of SiC substrate is very high. Based on the data of Wolfspeed and other institutions, the price of a 4-inch SiC substrate is RMB 2000–3000 ($298.2-447.3) per piece, and the price of a 6-inch SiC substrate is RMB 6000-8000 ($894.6-$1192.8) per piece.

The price of SiC MOSFET is more than eight times that of the same level IGBT, being a vital hindrance to the SiC promotion, according to industry insiders.

Industry insiders said that based on the price trend in the past few years, the price of SiC is estimated to fall by half in five years. The increased production capacity will speed up the price decline. The price of SiC of the same specification could be reduced to less than three times that of IGBT in another four to five years.

RELATED

-

The IC design subsidiary of China’s listed IC distributor P&S completes testing of its first MCU product for automotive standard

11-20 16:26 -

Winsoul Capital: The market size of China’s power semiconductors is expected to increase to $20.6 billion by 2024

11-20 16:08 -

Chinese electronic component company CETC mass produceds its Beidou satellite communication module for China’s major EV maker

11-20 15:55