By Kate Yuan

Chinese EV giant BYD is adopting more SiC power devices in its vehicles, and the proportion is expected to rise more than 50% in the short term. The growing demand for SiC may benefit related companies in the supply chain, according to a JW Insights report on December 7.

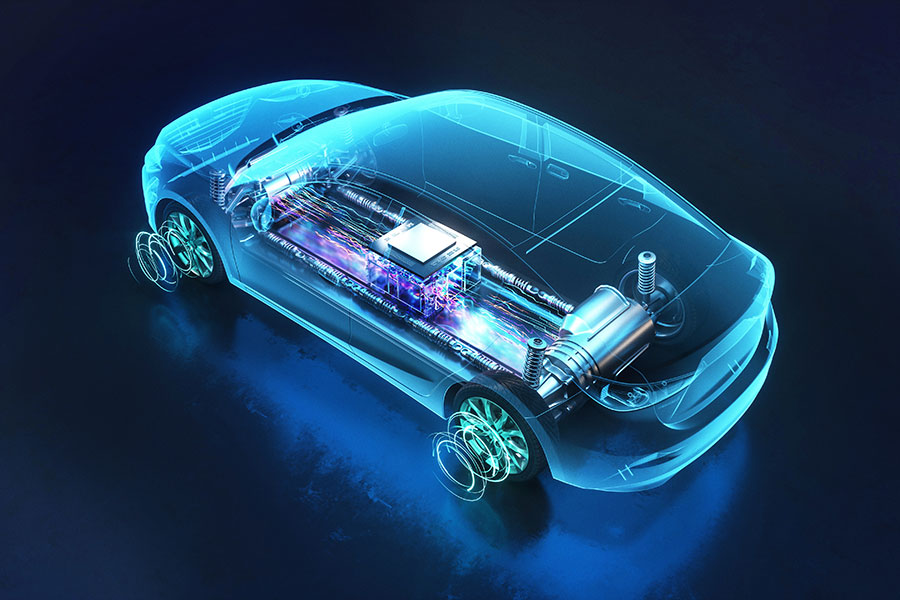

The new energy vehicles boom has resulted in rocketing demand for power devices. SiC has become the first choice of NEV makers with lower energy loss, smaller packaging size, higher frequency switches, better high-temperature resistance and heat dissipation. These features will help reduce power consumption, extend driving range, and develop smaller and lighter vehicles.

"Tesla's unit power consumption is lower than that of many EVs that use IGBTs. The use of SiC is an indispensable factor," an industry insider said.

Tesla announced using SiC power devices in its Model 3 in September 2021. Statistics showed that among the best-selling medium-sized and medium-to-large pure EVs in 2021, Model 3 ranked first with 12.6kWh power consumption per 100 kilometers.

This has stimulated more Chinese carmakers to replace IGBTs with SiC, making SiC one of the selling points. Xpeng, Great Wall, Nio, and Geely all have models equipped with SiC. Li Auto and FAW also have such plans.

As the world's largest EV maker, BYD is speeding up the adoption of SiC. Related models include Han EV, Tang EV, Destroyer, and Seal.

BYD sold 1.6 million EVs in 2022 as of November, and forecast that its global sales will hit 4 million in 2023 and 6 million in 2025. Sales of SiC models will also increase accordingly, and are expected to reach 100,000 in 2022 and may surge to 400,000 in 2023.

As the leader in SiC vehicles, Tesla delivered 655,000 vehicles in the first 11 months this year in its Shanghai Gigafactory alone. In the future, BYD is expected to become another growth pole for SiC cars. More high-end models and even models under RMB200,000 ($28,740) may be equipped with SiC.

The rising demand has led to growing concerns for the supply chain. At the beginning of this year, BYD suffered from the shortage of IGBT, which affected its normal production. Considering SiC could also face such problems, BYD will be more cautious in building the SiC supply chain.

Currently, BYD can produce a certain scale of SiC modules itself, but it is still highly dependent on overseas suppliers including Bosch and STMicroelectronics, whose top priority is Tesla, and can not guarantee the supply for other companies including BYD.

BYD's 6-inch SiC wafer production line will meet the demand of 1 million to 1.2 million vehicles after its mass production in 2024-2025. GTA Semiconductor (积塔半导体) and SMIC will continue to provide support before that.

In terms of modules or devices, related providers include ASI (国联万众), NCI (中电科15所), Sanan IC (三安集成), Hestia Power (瀚薪科技), Astsic (爱仕特), Starpower (斯达半导), AccoPower (芯聚能), Silan Micro (士兰微), GPT(泰科天润), and CR Micro (华润微). The former five are BYD’s current suppliers.

Substrates and epitaxial wafers are currently in tight supply in SiC production capacity. Suppliers including SICC (山东天岳), Tankeblue (天科合达), Synlight (同光晶体), CISRI (中科钢研), Epiworld (瀚天天成) and TYSiC (天域半导体) may benefit from the growing demand for SiC.

In addition, BYD may prefer IDM suppliers that could ensure the stability of future supply security. For example, InventChip (瞻芯电子), a BYD supplier backed by Xpeng, announced the strategic transformation from fabless to IDM after producing automotive SiC chips in July this year.

RELATED

-

BYD plans to establish a sodium-ion battery plant in eastern China’s Xuzhou with an investment of RMB10 billion ($1.4 billion)

11-20 17:51 -

The IC design subsidiary of China’s listed IC distributor P&S completes testing of its first MCU product for automotive standard

11-20 16:26 -

Chinese electronic component company CETC mass produceds its Beidou satellite communication module for China’s major EV maker

11-20 15:55