China may be able to reconfigure existing equipment and accelerate domestic development of lithography tools despite facing the US-led lithography restrictions, chief analyst at SemiAnalysis Dylan Patel pointed out in a recent article.

While the US, Japan, and the Netherlands agreed to restrict China’s access to lithography equipment, the newly agreed lithography restrictions have many gaping holes regarding equipment, chemicals, and component supply chains, Dylan wrote.

While there is a tri-lateral agreement for blocking access to DUV lithography, there is no mention of how far back this goes. DUV is a very broad technology that includes Krypton fluoride (KrF), Argon Fluoride (ArF), and Argon Fluoride Immersion (ArFi) lithography.

If the goal is to prevent China from acquiring 14nm, 7nm, or 5nm process technologies, then the ban must reach a differing level of tooling capable of processing the features for these nodes. For example, TSMC’s 16nm and 12nm process technologies have a minimum metal pitch of 64nm. TSMC’s 7nm process technology has a minimum metal pitch of 40nm. TSMC’s 5nm process technology has a minimum metal pitch of 28nm, according to Patel.

Any ban on lithography equipment must consider these minimum metal pitches as the specifications for banning equipment.

China’s SMIC have achieved 7nm process technology, without EUV, using SAQP with argon fluoride immersion (ArFi) lithography, but that isn’t the limit of what’s economically achievable.

The 28nm minimum metal pitch used on TSMC’s N5 could be manufactured without EUV.

If the goal is to stop China from achieving 5nm process technology, then ArFi shipments must be blocked. ASML and Nikon can manufacture ArFi lithography tools capable of 28nm minimum metal pitch, added Dylan Patel.

If the goal is to prevent China from achieving high volume 7nm process technology, then all tools that can achieve a 40nm minimum metal pitch used on TSMC 7nm class process technologies must be blocked. The new restrictions would include ArFi lithography, but they would also need to extend further.

If the goal is to prevent China from expanding their high volume 14nm process technology, then all tools that can achieve a minimum metal pitch of 64nm used on nodes, such as TSMC’s 16nm and 12nm and Samsung’s 14nm, must be blocked.

The next gap in the new export controls is the chemical supply chain, namely photoresist. The complete lack of restrictions around photoresists represents a significant hole that governmental regulations have not contemplated.

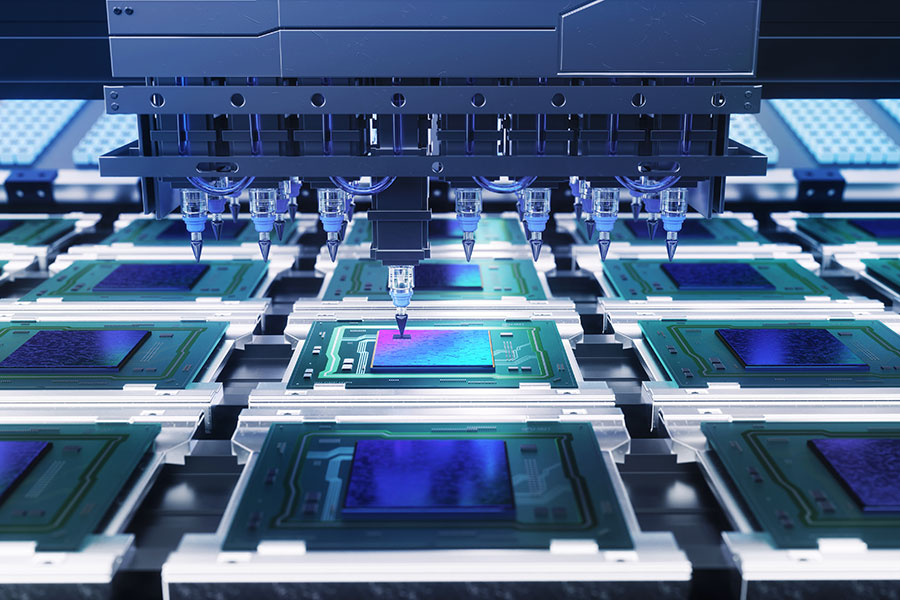

There are over a hundred DUV tools already at SMIC alone. These could be reorganized and shifted to fabricate for different process nodes. SMIC could achieve a capacity of well over 100,000 wafers a month of 7nm foundry capacity with their existing DUV tools alone. This is higher than Samsung and Intel’s advanced node (<=7nm) foundry capacity, combined. If all DUV tools at various Chinese nationals such as HuaHong, Shanghai Huali, YMTC, CXMT, GTA Semi, Nexchip, Yandong, Nexperia, CR Micro, Sien, Fulsemi, SEMC, NSEMI were reappropriated by SMIC, the 7nm capacity they could build would far exceed that of even TSMC’s 7nm.

This leads to the final gap, the component supply chain. DUV tools must be regularly serviced with replacement parts by ASML, Nikon, and Canon.

While China’s lithography champion, SMEE, is on the sanctions list, SMEE has already shipped working I-Line lithography tools.

Lastly, mask related tools also have zero restrictions, which is also a hole, Dylan Patel noted.

(Gao J)

RELATED

-

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

The IC design subsidiary of China’s listed IC distributor P&S completes testing of its first MCU product for automotive standard

11-20 16:26

READ MOST

No Data Yet~