(JW Insights) Jun 26 -- U.S. new multilateral semiconductor export controls targeting China may actually push Chinese firms to innovate their way into the big league, though China’s semiconductor wafer fabrication companies are way behind their Western and Japanese peers, according to an article by industry insider Kyriakos Petrakakos published on news platform The China Project on June 15.

Kyriakos Petrakakos is a strategy and corporate development executive in the semiconductor equipment industry. He has spent ten years in Greater China, studying Mandarin in Beijing and working in Shanghai and Hong Kong.

Key points in his article:

In October 2022, the U.S. Commerce Department put in place export control measures limiting China’s access to U.S. semiconductor technology on national security grounds. These effectively deny China access to the most advanced computer chips, and to the software and equipment that are needed to produce them.

China has taken significant steps to prop up its domestic semiconductor industry. Toward the end of 2022, the government earmarked $143 billion to bolster the domestic semiconductor market over a five-year period. Several municipal and provincial governments announced similar initiatives, with Guangzhou setting $29 billion aside for investments in tech, including semiconductors.

The Chinese semiconductor equipment industry didn’t emerge until the noughties.

In the years that followed, successive Chinese governments elevated their aspirations for integrated circuits (IC) autonomy to the country’s Five-Year Plans.

To become self-sufficient, China resorted to industrial policies. It set production goals, offered subsidies and tax benefits, erected trade and investment barriers, and promoted foreign-domestic joint ventures.

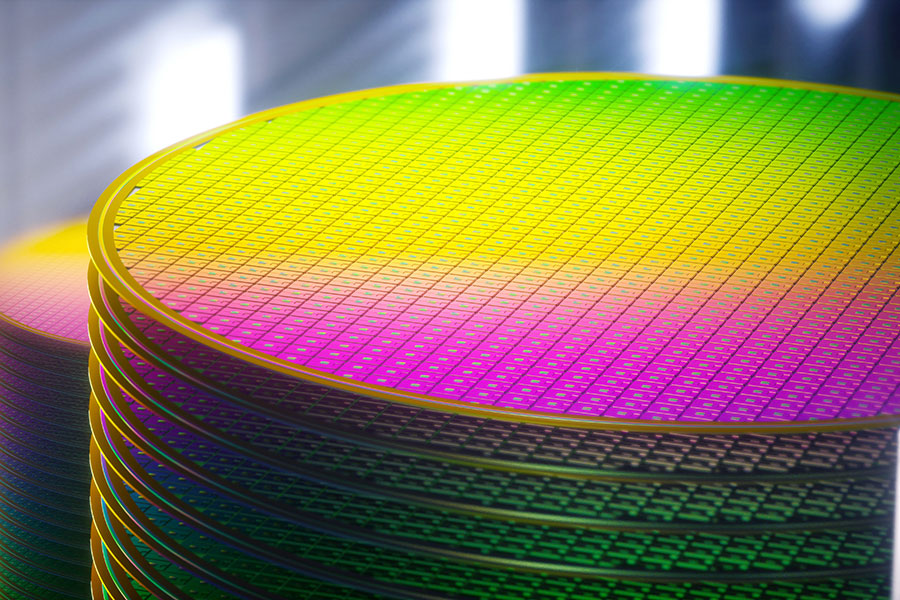

Wafer fabrication equipment had historically been the neglected sibling in the broader Chinese semi landscape. While inroads were being made in areas such as assembly, testing and fabrication, Chinese equipment consistently trailed far behind that of global OEMs, in both technology and market share. This course is being reversed by trade sanctions that intrinsically link Chinese IC self-sufficiency to the development of locally produced chipmaking tools.

Most local fabrication equipment manufacturers are already benefiting from a larger serviceable market in mature nodes created by the changing geopolitical landscape. The export curbs will have a positive effect on Chinese semiconductor self-sufficiency, but that will be limited to chips used in cars, servers or domestic appliances. Currently, the aspiration of building a fully autonomous ecosystem capable of churning out advanced ICs is still well beyond the capabilities of the current semi-cap supply base, said the article by Kyriakos Petrakakos.

RELATED

-

Apple’s Chinese supplier Luxshare Precision gives up $330 million investment in India

11-20 17:28 -

European Commission President von der Leyen will visit China in wake of the EU’s ongoing probe into China’s subsidies on EV industries

11-20 16:59 -

The IC design subsidiary of China’s listed IC distributor P&S completes testing of its first MCU product for automotive standard

11-20 16:26

READ MOST

No Data Yet~